Cooperativismo y Desarrollo, May-August 2024; 12(2), e706

Translated from the original in Spanish

Original article

Analysis of the risk integral management in a company of the transportation sector

Análisis de la gestión integral de riesgos en una empresa del sector del transporte

Análise do gerenciamento integrado de riscos em uma empresa do setor de transportes

Luis Manuel Román Torres1  0009-0001-1298-9384

0009-0001-1298-9384  luismanuelromantorres@gmail.com

luismanuelromantorres@gmail.com

Maria Eugenia Ramos Crespo2  0000-0001-7354-5405

0000-0001-7354-5405  mariae@upr.edu.cu

mariae@upr.edu.cu

Roberto Enrique Taño Lazo2  0000-0002-4220-0305

0000-0002-4220-0305  roental.1238@gmail.com

roental.1238@gmail.com

Brígido García Páez2  0000-0003-4094-7453

0000-0003-4094-7453  brigido.garciap@upr.edu.cu

brigido.garciap@upr.edu.cu

1 Agricultural Transportation Company. Pinar del Río, Cuba.

2 University of Pinar del Río "Hermanos Saíz Montes de Oca". Pinar del Río, Cuba.

Received: 8/12/2023

Accepted: 1/07/2024

ABSTRACT

This research was carried out in the Agricultural Transportation Company of Pinar del Río

province, due to the need to define the vulnerabilities of the risk integral management system

implemented by this organization. The objective of this article is focused on analyzing the current state of

the risk integral management in the Agricultural Transportation Company of Pinar del Río, which

will allow knowing the vulnerabilities in the process to

improve quality, protection and safety without compromising efficiency and sustainability. The historical-logical method was used in order

to analyze the evolution, operation and development of risk integral management in companies

of the transport sector; the analysis-synthesis, which allowed revealing the essential relations

and more general characteristics of risk integral management. Among the research techniques

used were the interview, survey, checklists and documentary analysis,

whose results were processed to arrive at conclusions with the help of the statistical method, as well as the Ishikawa

diagram, to determine the cause-effect relationships in the risk integral management process.

As main results of the diagnosis, the insufficient risk integral management in the company

stands out, where the causes and subcauses are determined by each stage of the risk management life

cycle, being the identification stage the one with the highest number, however, each of the

problems detected have an impact on the other functions due to the systemic nature of the process.

Keywords: analysis; integral management; risks; risk integral management.

RESUMEN

La presente investigación se desarrolló en la Empresa de Transporte Agropecuario de la

provincia de Pinar del Río, por la necesidad de definir las vulnerabilidades del sistema de gestión

integral de riesgos que implementa dicha organización. El objetivo del presente artículo se centra

en analizar el estado actual de la gestión integral de riesgos en la empresa de Transporte

Agropecuario de Pinar del Río, lo que permitirá conocer las vulnerabilidades en el proceso para

mejorar la calidad, protección y seguridad sin comprometer la eficiencia y la sustentabilidad. Se utilizó

el método histórico-lógico a fin de analizar la evolución, funcionamiento y desarrollo de la

gestión integral de riesgos en empresas del sector del transporte y el análisis-síntesis, que

permitió revelar las relaciones esenciales y características más generales de la gestión integral de

riesgos. Entre las técnicas de investigación empleadas, se encuentran la entrevista, encuesta, las listas

de verificación y el análisis documental, cuyos resultados fueron procesados para arribar a

conclusiones con ayuda del método estadístico, así como el diagrama de Ishikawa, para determinar las

relaciones causa-efecto en el proceso de gestión integral de

riesgos. Como principales resultados del diagnóstico, resalta la

insuficiente gestión integral de los riesgos en la empresa, donde las

causas y subcausas están determinadas por cada etapa del ciclo de vida de la gestión de riesgos,

siendo la etapa de identificación la de mayor número, sin embargo, cada una de las

problemáticas detectadas impactan en las demás funciones debido al carácter sistémico del proceso.

Palabras clave: análisis; gestión integral; riesgos; gestión integral de riesgos.

RESUMO

Esta pesquisa foi realizada na Empresa de Transporte Agropecuário de Pinar del Río,

na província de Pinar del Río, devido à necessidade de definir as vulnerabilidades do

sistema de gerenciamento integrado de riscos implementado por essa organização. O

objetivo deste artigo é analisar o estado atual do gerenciamento integrado de riscos na

Empresa de Transporte Agrícola de Pinar del Río, o que nos permitirá identificar as

vulnerabilidades do processo para melhorar a qualidade, a proteção e a segurança sem comprometer

a eficiência e a sustentabilidade. O método histórico-lógico foi usado para analisar

a evolução, o funcionamento e o desenvolvimento do gerenciamento integrado de

riscos em empresas do setor de transportes, e o método de análise-síntese foi usado

para revelar as relações essenciais e as características mais gerais do gerenciamento

integrado de riscos. As técnicas de pesquisa utilizadas incluíram entrevistas, pesquisas, listas

de verificação e análise documental, cujos resultados foram processados para se chegar

a conclusões usando o método estatístico, bem como o diagrama de Ishikawa

para determinar as relações de causa e efeito no processo de gerenciamento integrado

de riscos. Os principais resultados do diagnóstico destacam a insuficiência do

gerenciamento integrado de riscos na empresa, em que as causas e subcausas são determinadas

por cada etapa do ciclo de vida do gerenciamento de riscos, sendo a etapa de

identificação a que apresenta o maior número; no entanto, cada um dos problemas detectados

tem impacto sobre as outras funções devido à natureza sistêmica do processo.

Palavras-chave: análise; gerenciamento integrado; riscos; gerenciamento integrado de riscos.

INTRODUCTION

The mobilization or transportation of goods is a key aspect in the supply chain from the

supplier to the customer, ensuring the reliability of the shipment is a competitive tool and a

growing requirement for companies that perform this type of activity. There are additional operations

that involve risks from the moment of loading, during mobilization and unloading of the goods at

their final destination; these activities can cause damages, which can be direct, partial or total

damage of the goods, long delivery times, total loss of the cargo, or indirect: consequence of the

previous ones, such as loss of image of the company in the sector or loss of market share (an

important customer).

If the goods to be transported are foodstuffs, they are exposed to various environmental

factors such as temperature, humidity and light, which can affect the quality of the products in terms

of changes in their microbiological, physical and chemical composition, affecting their flavor,

texture and nutritional value. It can also cause the proliferation of microorganisms, triggering food

poisoning and other diseases related to food intake. The timely and satisfactory delivery of quality,

safety and security depends on this process.

For this reason, it becomes crucial for companies that provide this type of service to use

risk integral management as a tool to minimize the impact of risks on the system and improve

their competitive position in the sector. On many occasions this type of companies do not use a

global approach to the problem when selecting risk treatment strategies, making the logistic

supply chain more vulnerable; that is to say, a complete analysis of the impact generated by

the materialization of these risks on the operational balance of the organization is not carried

out. Risk management or administration, then, provides a better vision at the time of selecting

the way to treat them (Bedoya Arias & Villalba Salazar, 2004).

Considering that risk is an inherent aspect of almost every business activity, it is necessary

for professionals to learn how to identify, evaluate and hedge it in the best possible way. That is

why knowledge of risk assessment and hedging techniques is currently one of the most common

and frequent problems in which an economic entity may find itself.

Risk is nothing more than the existence of scenarios with the possibility of loss, it is the

probability that a hazard will cause an incident with consequences that are not feasible to be estimated in

a given activity during a defined period, it is the potential for losses that exists associated with

a productive operation, when the conditions defined as standards to ensure the operation of

a process or the productive system as a whole change in an unplanned manner

(Brito Gómez, 2018).

Risk management or risk administration is the science or discipline that is responsible for

analyzing, predicting, channeling and protecting the resources of a person, institution or company with

the greatest accuracy, against possible damages or losses that may occur, to reduce them as much

as possible in order to guarantee their permanence over time and achieve their goals with the

least amount of obstacles (Ribet Cuadot et al., 2015).

On the other hand, the Food and Agriculture Organization of the United Nations and the

Rural Development Agency of Bogota (2021) share the same criteria from the agricultural sector,

with a more comprehensive view and point out that it is a process of collective construction and

should be analyzed under a common vision of agricultural development, emphasizing that it

should provide a set of responses to identified situations and multidimensional challenges of a

structural, environmental and political nature, which is not merely productive, technological or

agricultural innovation.

On the other hand, Guerra Parada (2019) refers to a systematic process of decision making in

an environment of certainty about an event that may happen, whose probability and impact

brings adverse consequences if it materializes. It is an issue that should not be avoided in the

development of day-to-day business, but is a strategic challenge, if it is wanted to achieve better

performance, grow and compete within each sector, as it is a basic component of business management.

In itself, integral management implies a holistic, global administration of risks at all levels of

the organization, in order to facilitate the achievement of the strategic direction and decision

making, taking into account the interaction of the company with its environment, the relationship

with stakeholders, the interrelation between processes, as well as the implementation of

mechanisms that guarantee the continuity of the business and the protection of resources and interests.

The current regulation in Cuba that governs the internal control process and risk management

as one of its components is Resolution 60/2011 on internal control, which reflects the

general indications for the management and prevention of risks and establishes the bases for

their identification and analysis, although it does not internalize the different types of risks and

the methodology to be used for their classification and evaluation

(Ramos Crespo et al., 2013).

It does not integrate risk management into the strategic planning process of the entities, it

starts from its identification and ignores the definition of strategic and operational objectives,

information and compliance. This resolution does not establish the general framework for the management

of the organization's most significant risks, or in other words, risk strategic management. It

focuses on the identification of risks in a general and global manner in the entities and does not

particularize the different types of hazards to which any company is exposed, a situation that results in

the avoidance of strategic risks to a large extent

(Rodriguez Fajardo, 2022).

In accordance with the above, Rodriguez Fajardo

(2022) emphasizes that this regulation is not updated to the most recent version of the COSO IV report. For this reason, it ignores the

analysis of risks from an integral perspective with strategic planning in organizations. These

elements show the need to update the current standard based on the progress made both nationally

and internationally. In spite of what has been established, there are organizations that, due to

the lack of knowledge and highly qualified personnel, have been left behind in terms of risk

management (Garrido Cervera et al., 2022).

In Cuba, various regulatory bodies act precisely on disasters: the National Civil Defense

General Staff, the Environment Agency, the Insurance Company, the Comptroller General of the

Republic of Cuba, the Ministry of Agriculture, among others. Although treatment is provided from

different perspectives, neither the coherent management of risks associated with agricultural

productions nor the increase of the necessary production levels has been achieved

(Rodríguez Perea et al., 2019).

The legal instrument governing risk management is Resolution No. 60 of 2011 of the Office of

the Comptroller General of the Republic of Cuba in accordance with which the Higher Organization

of Business Management of the Tobacco Business Group of Cuba, to which the Agricultural

Transport Company Pinar del Río is subordinated, prepared a Management Manual and a Risk

Prevention Plan that is assumed by the entity, but none of these documents constitutes a concrete

and effective methodology to manage them and prevent their occurrence. Therefore, the objective

of this article focuses on analyzing the current status of risk integral management in the

Agricultural Transportation Company of Pinar del Río, which will allow knowing the vulnerabilities in

the process to improve quality, protection and safety without compromising efficiency and sustainability.

MATERIALS AND METHODS

The historical method was used in order to analyze the evolution, operation and development

of the risk integral management in companies of the transportation sector; for this purpose,

significant updated materials were consulted and the analysis-synthesis, which made it possible to

reveal the essential relationships and more general characteristics of integrated risk management.

The dialectic method was used to learn about the development and evolution of the risk

integral management, from its emergence to the current conceptions, the theoretical,

methodological and practical changes that have led to its development.

The systemic method was use because the risk integral management is analyzed as a

holistic system that allows companies to comprehensively manage the various risks to which they

are exposed and which affect their stability.

Among the empirical methods are the application of surveys and documentary analysis

carried out with the purpose of evaluating all the regulations and provisions in force on safety

systems, prevention plans, and worker protection, among others, and direct observation carried out

in each of the areas, including facilities, equipment, means of transportation, furniture,

production areas and warehouses.

The research techniques used included interviews, surveys, checklists and documentary

analysis. Observation or inspection of the different areas is carried out with the objective of verifying

the technical condition of the work equipment, transportation and construction of the facilities.

Interviews with experts and managers from different areas of the company were conducted

to determine the degree of awareness for the execution of the task of the ricks integral

management. Surveys were applied to workers, administrative and managerial staff in order to verify the

level of training and awareness they have to face the risks they are exposed to and how they

assume them.

RESULTS AND DISCUSSION

The Agricultural Transport Company Pinar del Río was created by Resolution No. 54/76 of

December 15, 1976, of the Minister of Agriculture, subordinated to the Territorial Delegation of the

Ministry of Agriculture in the Province of Pinar del Río; it is one of the most important

transportation companies in the province and at the national level. It has a General Management and

three Basic Business Units (UEB), these are:

- UEB de Transporte Consolación del Sur, with brigades in Consolación del Sur

and Los Palacios

- UEB de Transporte José Argibay Rivero located in the municipality of Pinar del

Río, with brigades in the municipalities of Mantua, Sandino, San Juan y Martínez and

Pinar del Río

- UEB Logística located in the municipality of Pinar del Río

The company's corporate purpose is to provide motor freight transportation services to

companies belonging to the aforementioned Ministry, and others related to insurance and support forces

for the different crops: tobacco, coffee, rice, forestry and other crops. By agreement

No. 4877 of December 7, 2003, the Executive Committee of the Council of Ministers approved

the implementation of Business Improvement in the entity. Through Resolution No. 22 of 2017,

the portfolio of services that make up the fundamental activity of the entity is approved:

forestry products, soil amenders, dry and green tobacco, fertilizers, phytosanitary products,

construction materials, agricultural products, raw materials and materials, personnel, miscellaneous

products and tobacco inputs.

Its mission is to satisfy the services of freight transportation by automotive means to entities

of the agricultural system and third parties, according to the requirements of customers

and stakeholders, with a high management of human, financial and internal control resources with

an efficient and sustainable performance that allow the continuous improvement of the company.

The vision of being a recognized company in the provision of freight transportation services in

the country, with quality and competitiveness of the same, in correspondence with the

requirements and expectations of customers and stakeholders, adapting to changes that occur in the

environment being a sustainable and sustainable entity, constantly improving.

The key result areas (ARC in Spanish) are as follows:

- ARC I - Transportation Services

- ARC II - Business Economic Efficiency and Financial and Tax Obligations

- ARC III - Human Capital Management

- ARC IV - Technical and Development

- ARC V - Logistics

- ARC VI - Defense, Security and Safety

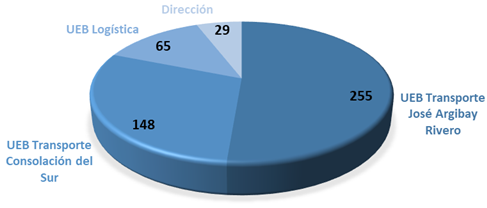

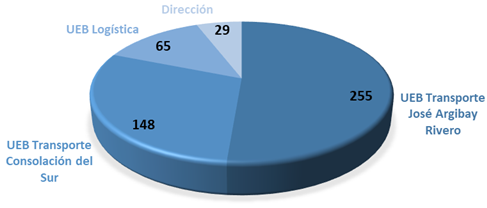

The Company has a total of 497 employees, distributed as follows:

Figure 1. Number of workers of the Empresa Transporte Agropecuario Pinar del Río per UEB

Source: Own elaboration

One of the components of Resolution No. 60/2011 of the Office of the Comptroller General of

the Republic of Cuba is the management and prevention of risks faced in order to achieve the

objectives set at each level of the Company. In the case of the entity under study, it has a manual

provided by the Grupo Empresarial de Tabaco de Cuba, with the aim of contributing to the

implementation and compliance with the rules of the Internal Control System, aimed at all workers of the

Empresa Transporte Agropecuario de Pinar del Río, however, it does not provide a comprehensive

analysis of the risks.

It was found that, although a group for risk management and prevention has been declared at

the Company and UEB levels, only one person is in charge of this, who is the company-level

cadre specialist whose work content differs from that of risk integral management.

As for the implementation of the manual that serves as a guide to manage risks, in its

identification, those linked to natural or social-natural disasters are declared, that is, it does not function as

a risk integral management unit that encompasses the institution's corporate risks and helps

to manage them to reasonably guarantee compliance with the organizational objectives that are

set annually. On the other hand, the principles and requirements that characterize risk

management in Cuban companies are included, but they have not been applied with a system approach

or incorporated as necessary elements within the general management process. In addition,

the insufficient use of risk management techniques stands out, which was verified in the

company's risk prevention plan where the confusion between risks and their causes can be observed.

The above aspects determined the need to carry out a diagnosis of the

risk integral management of the Empresa de Transporte Agropecuario of Pinar del Río province.

The methodology used in the diagnosis consisted of the following stages:

- Definition of the objectives and scope of the diagnosis

- Determination of information needs

- Definition of information sources

- Design of formats for the collection of information.

- Sample design

- Data collection, analysis and processing of information

- Presentation of the report

1. Definition of the objectives and scope of the diagnosis

The objective was aimed at diagnosing the current state of the risk integral management of

the Empresa de Transporte Agropecuario of Pinar del Río province, through an exhaustive

analysis that would allow explaining the facts, deepening the essential relationships and

circumstances that affect this process. The scope of the diagnosis was framed in the company together with

its UEBs.

2. Determination of information needs

Based on the above, the following are identified as information needs for the diagnosis:

- Perception of managers, administrators and workers in general about the rick

integral management in their work area

- How the theme influences the strategic planning of the entity

- Organizational culture favors risk management

- How risks are managed in the entity

- The level of risks identification by area

- Follow-up of risks in the entity

- Degree of awareness on the part of managers for the execution of the task that will

be assigned to them in risk management

3. Definition of information sources

The secondary sources of information consulted were:

- Business Strategy of Trasporte Agropecuario de Pinar del Río

- Risk management and prevention manual

- Risk assessment methodology proposed in the Risk Management and Prevention Manual

- Implementation of Resolution No. 60 of 2011

- Risk Prevention Plan

- Minutes of the Boards of Directors

- Results of audits performed in previous years

- Entity's training plan

The observation or inspection of the different areas is carried out with the objective of

verifying the technical condition of the work equipment, transportation and the constructive condition

of the installations.

After analyzing the results of the secondary information, it became evident that they are

not sufficient to evaluate the risk integral management process in the entity, therefore, other

sources of information such as primary sources (surveys and interviews) were used.

4. Design of formats for data collection

In the documentary analysis, a concatenated order was established on materials dealing

with risk integral management, this being fundamental for recognizing the efforts made and the

aspects that affect its integral performance.

A guide was designed for the documentary

review, where:

- The legal and institutional framework within which risk integral management is

performed in the company is analyzed

- It is known how risk integral management is conceived within the strategic planning tools

- The responsibilities, functions and attributions of the workers in the integral

management of the company are analyzed

For the observation, a guide was made, where:

- The constructive state of the installation, the company's vehicle fleet and its safety

are verified

- The use of adequate vehicles for food transportation and their maintenance condition

is reviewed

- It is checked if there is signage in the areas where workers and vehicles circulate.

Adequate lighting

- It is checked whether breaks are taken while driving

- It is checked how loads are handled

- The vehicle is checked for sanitation and hygiene for the intended use

Interviews with experts and managers from different areas of the company, with the objective

of determining the degree of awareness for the execution of the task of occupational risk

integral management.

Surveys applied to workers, administrative and management personnel to verify the level

of training and awareness they have to face the risks they are exposed to and how they

assume them.

5. Sample design

For the application of the interviews with specialists, experts and managers, it was not

necessary to apply a sampling technique due to the size of the population. Therefore, a total of 9

interviewees were interviewed, taking into account their experience, level of responsibility and knowledge

of risk integral management and the activities to be carried out by each key result area.

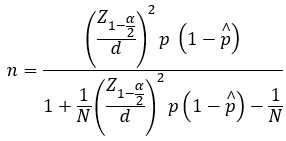

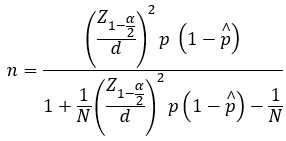

The survey was applied to a total of 64 workers; to determine the representative sample, it

was worked with a population of 497 workers in the entity (Table 1). It was determined that

the sample should be random or probabilistic, as it is the most appropriate in survey research

designs. For the calculation of the total sample size with a confidence level of 95% and a maximum

error of 5%, using the expression for the calculation of the sample in finite and known populations

of Calero Vinelo (1978).

To determine the sample for each area, stratified sampling was chosen (Table 1), so a

stratified probability sample was designed. In addition, the sample elements within each stratum

were selected from a table of random numbers, so that all had the same probability of being chosen.

Table 1. Summary of headcount by occupational category and organizational structure

Structure |

Population |

Sample |

1 |

Direction |

29 |

12 |

2 |

UEB José Argibay Rivero |

255 |

19 |

3 |

UEB Consolación del Sur |

148 |

18 |

4 |

UEB Logística |

65 |

15 |

5 |

General total |

497 |

64 |

Source: Business Strategy of Trasporte Agropecuario de Pinar del Río

6. Data collection, analysis and processing of information

The interviews were conducted at the work center of each specialist, based on recordings

made with the permission of each interviewee and the author's notes. The surveys were applied

within the framework of a training activity aimed at the risk integral management of the

company, where the purpose of the research, the most relevant conceptual aspects and the objective of

the instrument to be applied were explained to them.

The survey was processed with the help of Excel 2020 and inferential and multivariate

descriptive statistics were used, using the Statistical Package for the Social Sciences (SPSS) program,

which facilitated the tabulation and presentation of quantitative results through graphs. With respect

to the qualitative responses (judgments, opinions and knowledge), the ideas expressed were

related and similar results were summarized in order to refine and concentrate the ideas generated.

7. Summary of the main regularities of the diagnosis

From the information obtained in the diagnosis, it was proceeded to triangulate the

information, visualizing it in an Ishikawa diagram, where the effect or problem (insufficient risk

integral management in the company) is located on the right side of the central spine, the main

spines were represented by the life cycle of risk management assuming the Australia and New

Zealand Standard (2004) summarized in five of them (identification, evaluation, treatment,

monitoring and communication), which are the basis for the main risk management regulations,

including the COSO report and ISO 31000 to classify the causes and subcauses derived from the

risk integral management problems associated with each one, for a total of 21 subcauses,

being identification the one with the largest number of these, however, it is valid to recognize that

each of the problems detected impact the other functions due to the systemic nature of the

process (Figure 2).

This diagram was created based on the problems identified from the secondary and

primary sources. Subsequently, group work was carried out to sort them by function and priority. With

the information obtained, a list of causes is made, which is reduced by eliminating those that

are redundant and subjected to the individual assessment of the specialists, as recommended

by Cuesta Santos (2010) to know the order of importance from 1 to n, being one

the most important cause, two the next in importance, up to n, the least important.

Figure 2. Ishikawa diagram

Source: Prepared by the authors

The diagnostic study made it possible to determine the current status of the risk

management and prevention process in the entity. The results indicated that it is a process that is not

managed with a systemic, holistic and integrative approach.

The lack of tools that provide methodological resources for their management limits their

effective and efficient operation.

The diagnostic report presented is the starting point for a proposed solution to the

problem identified, which is related to the insufficient integral management of the company's risks.

Together with the systematization of theoretical and methodological references, associated to the

risk integral management process, it will contribute, to a great extent, to improve it in the

organization under study, whose proposal will be shown in future publications.

REFERENCES

Bedoya Arias, D. M., & Villalba Salazar, N. (2004). Gerencia de riesgos en una empresa de

transporte de carga masiva. Revista Universidad

EAFIT, 40(135), 18-27.

https://publicaciones.eafit.edu.co/index.php/revista-universidad-eafit/article/view/870

Brito Gómez, D. (2018). El riesgo empresarial. Universidad y Sociedad, 10(1), 269-277.

https://rus.ucf.edu.cu/index.php/rus/article/view/806

Calero Vinelo, A. (1978). Técnicas de

muestreo. Pueblo y Educación.

https://openlibrary.org/books/OL4147086M/Te%CC%81cnicas_de_muestreo

Cuesta Santos, A. (2010). Tecnología de gestión de recursos

humanos. Félix Varela / Academia. https://www.libreriavirtual.cu/libreria/tecnologia-de-gestion-de-recursos-humanos

Garrido Cervera, M., Poo Sobrino, Z., Figueroa Sierra, N., & Ribet Cuadot, M. de J.

(2022). Metodología para la gestión y prevención de riesgos en una Cooperativa de Producción

Agropecuaria. Cooperativismo y Desarrollo,

10(1), 24-43.

https://coodes.upr.edu.cu/index.php/coodes/article/view/467

Guerra Parada, J. A. (2019). La Gestión del Riesgo Empresarial. Revista Nova et Vetera, 5(45). https://urosario.edu.co/revista-nova-et-vetera/omnia/la-gestion-del-riesgo-empresarial

Organización de las Naciones Unidas para la Alimentación y la Agricultura & Agencia de

Desarrollo Rural. (2021). Plan integral de desarrollo agropecuario y rural con enfoque territorial. Tomo

1-Risaralda. Organización de las Naciones Unidas para la Alimentación y la Agricultura.

https://www.adr.gov.co/wp-content/uploads/2022/03/Tomo-1-Risaralda.pdf

Ramos Crespo, M. E., Figueroa Sierra, N., Garrido Cervera, M., & Sotolongo García, R.

(2013). Aplicación de una metodología para la administración de riesgos financieros como parte de

la gestión empresarial. Avances,

15(1), 29-39.

https://avances.pinar.cu/index.php/publicaciones/article/view/86

Ribet Cuadot, M. de J., Figueroa Sierra, N., Hernández Ribet, Y., & Artidiello Acosta, A. (2015).

La gestión y prevención de riesgos en las cooperativas: Un instrumento de trabajo para su

eliminación o reducción. Cooperativismo y

Desarrollo, 3(1), 1-12.

https://coodes.upr.edu.cu/index.php/coodes/article/view/90

Rodríguez Fajardo, L. M. (2022). Desarrollo histórico de la gestión de riesgos empresariales en

el marco del control interno y la contabilidad en Cuba: Antes y después de la Resolución 60

de 2011. De Computis, Revista Española de Historia de la

Contabilidad, 19(1), 103-122. https://doi.org/10.26784/issn.1886-1881.19.1.7290

Rodríguez Perea, O., Pérez García, W., & Salomón Llanes, J. (2019). Modelo para la

gestión integral de riesgos en la base productiva agrícola cubana. COFIN Habana, 13(3). https://revistas.uh.cu/cofinhab/article/view/832

Standards Australia & Standards New Zealand. (2004). Australian/New Zealand Standard: Risk

management (AS/NZS 4360:2004). Standards Australia / Standards New Zealand.

https://www.saiglobal.com/pdftemp/previews/osh/as/as4000/4300/4360-2004.pdf

Conflict of interest

Authors declare that they have no conflicts of interest.

Authors' contribution

All the authors reviewed the writing of the manuscript and approve the version finally submitted.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License

0009-0001-1298-9384

0009-0001-1298-9384  luismanuelromantorres@gmail.com

luismanuelromantorres@gmail.com 0000-0001-7354-5405

0000-0001-7354-5405  mariae@upr.edu.cu

mariae@upr.edu.cu 0000-0002-4220-0305

0000-0002-4220-0305  roental.1238@gmail.com

roental.1238@gmail.com 0000-0003-4094-7453

0000-0003-4094-7453  brigido.garciap@upr.edu.cu

brigido.garciap@upr.edu.cu