https://orcid.org/0000-0002-2887-7301

https://orcid.org/0000-0002-2887-7301 alexei.noda@pr1.pri.onat.gob.cu

alexei.noda@pr1.pri.onat.gob.cu

Cooperativismo y Desarrollo, May-August 2021; 9(2), 403-430

Translated from the original in Spanish

Implementation of a study material to develop the tax culture in the cooperative sector

Implementación de un material de estudio para desarrollar la cultura tributaria en el sector cooperativo

Implementação de um material de estudo para desenvolver a cultura tributária no sector cooperativo

Alexei Noda Rodríguez1; Yadira Hidalgo Castro2; Irisdany Gómez Quintana3; Amarilys de Jesús Pozo Contrera4

1 Oficina Nacional de Administración Tributaria (ONAT) Provincial de Pinar del Río. Pinar del Río, Cuba.

https://orcid.org/0000-0002-2887-7301

https://orcid.org/0000-0002-2887-7301

alexei.noda@pr1.pri.onat.gob.cu

alexei.noda@pr1.pri.onat.gob.cu

2 Universidad de Pinar del Río "Hermanos Saíz Montes de Oca". Facultad de

Ciencias Económicas y Empresariales. Departamento Contabilidad y Finanzas. Pinar del Río. Cuba.

https://orcid.org/0000-0001-5265-9198

https://orcid.org/0000-0001-5265-9198

yadira.hidalgo@upr.edu.cu

yadira.hidalgo@upr.edu.cu

3 Universidad de Pinar del Río "Hermanos Saíz Montes de Oca". Facultad de

Ciencias Económicas y Empresariales. Departamento Contabilidad y Finanzas. Pinar del Río. Cuba.

https://orcid.org/0000-0002-1754-1271

https://orcid.org/0000-0002-1754-1271

irisdany.gomez@upr.edu.cu

irisdany.gomez@upr.edu.cu

4 Universidad de Pinar del Río "Hermanos Saíz Montes de Oca". Facultad de

Ciencias Económicas y Empresariales. Departamento Contabilidad y Finanzas. Pinar del Río. Cuba.

https://orcid.org/0000-0001-6431-9182

https://orcid.org/0000-0001-6431-9182

amarilys@upr.edu.cu

amarilys@upr.edu.cu

Received: 23/11/2020

Accepted: 4/06/2021

ABSTRACT

The economic transformations that have taken place in Cuba as part of the process of updating the Cuban economic model have led to a constant improvement in the regulations in force. As a result, Cuban tax regulations have been evolving with an acceptable degree of harmonization, together with the improvement of curricula aimed, among other issues, at training human capital with the necessary knowledge, skills and values. This constitutes a challenge for Higher Education, which contributes to the strengthening of the cooperative sector from the very development of the tax culture. This development is achieved to a great extent, from the inclusion of contents related to the tax system in the cooperative sector, from the subject Financial Administration of the State, in the Bachelor's Degree in Education. Economics, at the University of Pinar del Río. Hence, the objective of this article is: to elaborate a study material to contribute to the development of tax culture from the topics of tax calculation in the cooperative sector in third year students of the referred career. The research was developed on a dialectical-materialist basis and theoretical and empirical qualitative and quantitative methods were used, which allowed for a theoretical-practical assessment of the educational reality. The proposal was applied in educational practice with satisfactory results, and was also submitted to the criteria of specialists, who considered it to be viable under current conditions.

Keywords: cooperativism; tax culture; study material; cooperative sector

RESUMEN

Las transformaciones económicas ocurridas en Cuba como parte del proceso de actualización del modelo económico cubano han conllevado a un constante perfeccionamiento en las normativas vigentes. Como consecuencia de ello, la normativa tributaria cubana ha ido evolucionando con un grado aceptable de armonización, a la que se une el perfeccionamiento de los planes de estudios dirigidos, entre otras cuestiones, a formar el capital humano con conocimientos, habilidades y valores necesarios. Esto constituye un reto para la Educación Superior, el cual tributa al fortalecimiento del sector cooperativo desde el propio desarrollo de la cultura tributaria. Desarrollo este que se logra en gran medida, a partir de la inclusión de contenidos relacionados con el régimen tributario en el sector cooperativo, desde la asignatura Administración Financiera del Estado, en la carrera Licenciatura en Educación. Economía, de la Universidad de Pinar del Río. De ahí que el presente artículo tiene como objetivo: elaborar un material de estudio para contribuir al desarrollo de la cultura tributaria desde los temas del cálculo de impuestos en el sector cooperativo en los estudiantes de tercer año de la referida carrera. La investigación se desarrolló sobre una base dialéctico-materialista y se emplearon métodos teóricos y empíricos de tipo cualitativo y cuantitativo, los cuales permitieron realizar una valoración teórico-práctica de la realidad educativa. La propuesta fue aplicada en la práctica educativa con resultados satisfactorios, además, fue sometida al criterio de los especialistas, los que consideran que es viable en las condiciones actuales.

Palabras clave: cooperativismo; cultura tributaria; material de estudio; sector cooperativo

RESUMO

As transformações económicas ocorridas em Cuba como parte do processo de atualização do modelo económico cubano tem levado a uma melhoria constante da regulamentação em vigor. Como resultado, a legislação fiscal cubana tem vindo a evoluir com um grau de harmonização aceitável, juntamente com a melhoria dos currículos destinados, entre outras questões, à formação de capital humano com os conhecimentos, competências e valores necessários. Isto constitui um desafio para o Ensino Superior, que contribui para o reforço do sector cooperativo a partir do próprio desenvolvimento da cultura fiscal. Este desenvolvimento é largamente alcançado através da inclusão de conteúdos relacionados com o sistema fiscal no sector cooperativo, a partir do curso de Administração Financeira do Estado, na Licenciatura em Educação. Economia, na Universidade de Pinar del Río. Assim, o objectivo deste artigo é preparar um material de estudo que contribua para o desenvolvimento da cultura fiscal a partir dos tópicos de cálculo de impostos no sector cooperativo em estudantes do terceiro ano da referida carreira. A investigação foi desenvolvida numa base dialético-materialista e foram utilizados métodos teóricos e empíricos qualitativos e quantitativos, o que permitiu uma avaliação teórico-prática da realidade educativa. A proposta foi aplicada na prática educativa com resultados satisfatórios, além disso, foi submetida ao critério dos especialistas, que consideram que é viável nas condições atuais.

Palavras-chave: cooperativismo; cultura fiscal; material de estudo; setor cooperativo

INTRODUCTION

Currently, it can be seen that in most countries tax evasion is a problem of enormous importance, so it is necessary to understand the tax phenomenon, to know the factors that affect it and, consequently, to be able to help design actions to weaken its negative consequences.

In this regard Mendoza, Palomino, Robles and Ramírez (2016, p. 67) state that:

It is worth considering that the lack of tax culture is the main cause of tax evasion and tax crimes, within which the tax administration in general is immersed, bringing as a consequence the improvement, mainly of the tax collection system and the high rates of tax evasion and fraud, as well as the lack of knowledge, on the part of the citizen, of the fulfillment of the formal duties established in the different laws governing taxes.

Similarly, Neira Galván (2019) posits that the non-existence of a Tax Culture in society is one of the fundamental factors affecting tax evasion. While Crespo, Carballo and Farinango (2019, p. 121) state:

Tax culture is the way in which the state makes taxpayers aware of their tax and fiscal responsibilities, it assumes the commitment to designing strategies to educate citizens on tax matters, facilitating compliance with taxpayers' responsibilities and raising awareness of the proper use of public goods and services provided.

This means that tax culture would explain why tax evasion by taxpayers occurs. In this context, different studies on tax culture were investigated. The results of this inquiry show that there are different studies carried out from its evolution, concept, contribution, indicators and others, such as: Bonilla (2014) analyzes the concept of tax culture, Sarduy and Gancedo (2016) analyze the factors of tax culture, Díaz, Cruz and Castillo (2017) perform a characterization on tax culture and study its trends, Gamboa, Hurtado and Ortiz (2017) study on tax evolution and its relationship with tax culture, Quispe, Arellano, Rodríguez, Negrete and Vélez (2019) set out to demonstrate three possible working hypotheses related to tax evasion and one of them is related to the influence of low tax culture on tax evasion.

But it is worth mentioning that tax evasion and the lack of tax culture are consequences of an incomplete or inadequate socialization of the ethical values of justice and solidarity. According to Castro (2012), the university education system should, as one of its obligations, explain to future professionals that complying with their tax obligations is a social behavior that promotes the general development of society, enables equal opportunities, improves security, economic growth and is also an act of solidarity with those who have less.

Hence, conceptually, tax culture in the research is understood as follows as:

The set of values, knowledge and attitudes shared by the members of society with respect to taxation and the observance of the laws that govern it; this translates into conduct manifested in the permanent fulfillment of tax duties based on reason, trust and the formation of the values of personal ethics with respect to the law, citizen responsibility and social solidarity, both of taxpayers and officials of the different tax administrations (Mendoza Shaw et al., 2016, p. 67).

Taking into account the above, it is deduced that the development of a tax culture requires a change of thinking, feeling and action of taxpayers, using education as a means, which is not an easy task. In order to facilitate this process, the tax culture has been given the task of educating society fiscally, facilitating compliance with the responsibilities of each taxpayer.

Cuban society is no stranger to this situation. In Cuba, since the mid-1990s, a profound tax reform took place that removed the foundations of the economy's taxation, as a strategic measure to counteract the effects of the economic crisis it was experiencing and the need to ensure its reinsertion in the world economy.

Since then, the Cuban revolutionary government has dedicated substantial resources to the implementation of a Fiscal Policy (including Tax and Budget). This policy fulfills its function in the redistribution of economic wealth and the assurance of income to the State Budget, with the purpose of supporting public spending at planned levels and maintaining an adequate financial balance. In this way, it contributes to the stability of the purchasing power of the national currency and to economic and social development.

With the modernization of the Tax Administration, the strengthening of the control culture and social awareness in this respect, taxes become an effective instrument for the regulation and management of the economy, as well as an instrument for the redistribution of income.

Despite all the efforts made, Sarduy and Gancedo (2016) state that, after almost twenty years of implementation of taxes in Cuba, there is still no generalized tax culture. They also emphasize that developing this tax culture, which is needed among taxpayers, implies an educational task as part of daily life. This educational work should be carried out by Higher Education Institutions (HEI), which, although they are not the only ones that carry out this work, in the particular case of this research, they are the fundamental ones.

According to the aforementioned authors, in order to preserve or maintain culture, it is necessary to train citizens who, as workers, appropriate and apply that culture and, in addition, enrich it by creating and promoting it; hence, university processes become the most efficient and systematic way for the preservation, development and promotion of tax culture.

In view of this, HEI must provide, then, a teaching-learning process (PEA in Spanish) oriented to the formation of knowledge, skills, attitudes and values that will enable future professionals to think and act in a cooperative way from different organizational forms. Due to the nature of the present research, we will focus the study in a particular way on Cooperatives as an organizational form, emphasizing cooperative education.

The Uruguayan Federation of Savings and Credit Cooperatives (Fucac, 2015, p. 11) states that, "The purpose of cooperative education is to make better cooperatives, better cooperators and, through the action of authentic cooperatives and committed cooperators, to contribute to the development of a more prosperous, harmonious, supportive and just society." Therefore, in cooperative education, the best forms or ways of teaching to educate the new generations must be taken into account.

In these forms of teaching, whichever is used, it is essential to strengthen the discipline of work, so that it favors the creation of a sense of belonging to the collective (García Pedraza et al., 2018). In this process, the transmission of the tax culture is very important, since it is not only about the tax regime in general terms, but referred to a form of legal organization of economic activity that presents peculiar characteristics, since it is a legal-economic structure that has its own nature. Therefore, it is not possible to speak of the tax regime of the cooperative by assimilating it to the regime of other forms of organization, since they are different. Herein lies the need to develop a tax culture in the cooperative sector.

The thematic under study is part of the knowledge system taught in the subject Financial Administration of the State, which belongs to the Finance discipline. This subject is taught in the third year of the Bachelor's Degree in Education. Economics. It deals specifically with aspects related to finance from the macroeconomic point of view, taking into account the process of modernization of the Financial Administration of the State that has taken place in recent years in Cuba, with emphasis on the cooperative sector and the implementation of the systems that integrate it. Given the importance of these aspects for the execution of economic and social development programs, it analyzes aspects related to public finances, where fiscal policy and the current tax system play a fundamental role, invariant elements in the knowledge system within the subject.

Taking into account the above elements, the following research objective is outlined: to elaborate a study material to contribute to the development of the tax culture from the topics of tax calculation of the cooperative sector in third year students of the Bachelor's Degree in Education. Economics, in Pinar del Río, in correspondence with the social demands of higher education.

MATERIALS AND METHODS

For the development of the research, the dialectical-materialist method was assumed as a general method and theoretical and empirical methods were used, which are detailed below:

As for the theoretical methods, the following were used:

As for the empirical methods, the following were used:

For the processing of the information, techniques were used to interpret, summarize and present the information obtained.

It is necessary to specify that the use of methods and techniques allowed classifying the information according to its level of significance and extracting the essence of the topic, allowing the authors to elaborate a study material with updated information on the tax culture in the cooperative sector, as a bibliographic support for the subject Financial Administration of the State, taught in the third year of the Bachelor's Degree in Education, Economics, at the University of Pinar del Río. Economics, at the University of Pinar del Río.

RESULTS AND DISCUSSION

The Financial Administration of the State as a subject in the Bachelor's Degree in Education. Economics

The subject, as an integral part of the Financial Administration discipline, is responsible for preparing students in aspects related to finance from the macroeconomic point of view. Its importance lies in the role of public finances within the economy, fundamentally in Cuba, where they play an important role in determining the economic needs of a public nature and the means to cover them, with the objective of guaranteeing equity and fairness in the distribution within the different layers of society, allowing social justice and protecting the lower income strata.

The subject contributes to the integral formation of students under the conception of a political formation based on the principles that govern socialist society, from an efficient financial administration of the State, its historical evolution and the role of public finances within the national economy. Likewise, it addresses fiscal policy, the budgetary and tax system according to the current requirements of the economic model in general, with particular emphasis on the cooperative sector.

It is specifically focused on the tax regime of cooperatives, since they have a complex nature, which does not coincide with any of the traditional forms of legal organization. Consequently, the tax treatment must be adapted to the nature of the cooperative in question, without ignoring the differences between them.

Its contents must be constantly updated according to the transformations adopted by the Cuban economic model, which makes it possible for the student to be prepared for the management of the pedagogical process of the counterpart programs in Technical and Professional Education. Here then lies the importance of developing the tax culture in students and thus promoting their role in the development of the cooperative sector, since these teachers in formation, once graduated, are incorporated as teachers to the polytechnic centers of the province, from where they have the social task of training middle technicians in accounting, which are inserted as accountants in the network of cooperatives in the province.

Only in this way, the implementation of the study material contributes to the development of the tax culture from the topics of tax payments, in the students of the referred career in Pinar del Río. At the same time, it constitutes a strong alternative for the formation of professional skills and thus the development of cooperativism in the province.

Some aspects of the tax regime in the cooperative sector

In Cuba, cooperativism represents a driving agent of local development with a marked impact on the agro-livestock sector (Padrón Carmona, 2015). As a result, in the country, about 55% of the productive forms that make up the agricultural sector are cooperatives, while in Pinar del Río they account for 64%; this evidences their remarkable participation in the Cuban agricultural market and particularly in Pinar del Río (Onei, 2020).

The term cooperative has been defined by several researchers, who analyze it from their point of view, respecting each other's criteria. Due to the existing diversity of criteria, the authors have decided to assume for the present research the definition published on August 30, 2019 in the Official Gazette of the Republic of Cuba: "organization with economic and social purposes, which is voluntarily constituted on the basis of the contribution of goods and rights and is supported by the work of its members" (Council of State of the Republic of Cuba, 2019, p. 1333).

The current tax system in correspondence with Guideline 49 of the VII Congress of the Communist Party of Cuba (PCC in Spanish) which proposes "to perfect the application of fiscal stimuli that promote national productions in key sectors of the economy, especially to exportable funds and those that substitute imports to local development and environmental protection" (PCC, 2017, p. 10), defines for the agro-livestock sector a special taxation regime, contained in Book V of the Tax Law No. 113 of 2012, which in its Article 359 states that:

Natural and legal persons engaged in agro-livestock activity, without prejudice to the payment of the remaining taxes in which taxable event they incur, pay taxes on Personal Income, on Profits, on Sales, on the Ownership or Possession of Agricultural Land, on the Idleness of Agricultural and Forestry Land, on Land Transportation, on the Use of Labor Force, as well as the Social Security Contribution, according to the specificities established in this Title (National Assembly of People's Power, 2012, p. 1736).

In this sense, the authors consider it necessary to prepare for the implementation of the tax system in the agro-livestock sector, a task that requires extra support that contributes to learning and information on why and for what purpose taxes and other legal obligations are paid in this sector.

This special regime is defined through tax exemptions (exemptions) and reductions in the amounts to be paid (bonuses), as well as other adjustments in the tax calculation elements established in the Tax Law in general, which determine that the tax burden, that is, the ratio between taxes paid and total income obtained, is lower in this sector than in the rest of the economy, which favors and stimulates agricultural development in the country.

Additionally, through the annual laws of the State Budget, other benefits have been approved with the same objectives, in view of the conditions in which the agro-livestock sector develops, such as exempting from the payment of the Tax for the Use of the Work Force, for the personnel hired directly to the agro-livestock production.

It should be noted that these aspects can be achieved if the tax culture can be developed through the teaching-learning process of the State Financial Administration subject in the Bachelor's Degree in Economics Education. This implies an educational work as part of daily life, reflected in the capacity to ask what the role of the citizen within society is, promoting values exposed in the behavior and perception of these, oriented to the duty to contribute to the financing of public expenditure.

The structural factors that make up the tax culture of a society are represented by the variables that shape the perceptions of citizens with respect to taxation and, consequently, influence their willingness to comply with their tax obligations.

Armas and Colmenares (2009, p. 130) define tax culture as "the set of knowledge, assessments and attitudes related to taxes, as well as the level of awareness regarding the duties and rights derived for the active and passive subjects of this tax relationship".

In this regard, guideline 51 states:

Promote tax culture and social responsibility of the population, entities and non-state forms of management in the country, in full compliance with tax obligations, to develop the civic value of contribution to the support of social expenditures and high levels of fiscal discipline (PCC, 2017, p. 10).

The above approach is related to one of the objectives of tax culture, which is aimed at creating in taxpayers the awareness that taxation is not only a legal obligation, but a duty of each person before society. In addition, they must be convinced that complying with this responsibility gives them the moral authority necessary to demand that the State make a correct and transparent use of public resources.

Hence, the development of tax culture in Universities should be seen as a systematic and permanent effort, based on principles, oriented to the cultivation of citizen values and, therefore, focused on both current taxpayers and tomorrow's citizens. Young people whose culture and vision of the world are in formation, which makes them more susceptible to internalize and make their own the values that in the future will determine their behavior within society and the cooperative sector as part of it.

Tax calculation in the cooperative sector

As explained above, the cooperative sector has a different tax regime from the rest of the sectors. Therefore, it is necessary to emphasize this type of content in the Financial Administration subject, in order to develop a tax culture in students. In this way, once they graduate, they will be able to have a direct influence on their students.

In this sense, it is important to exemplify how these operations are carried out through this subject. First, the calculation of the taxes to be paid on the idleness of agricultural land according to the amount established for each category in this sector and, secondly, on the annual liquidation of the personal income tax, by means of the affidavit to the individual producers of the sector, will be carried out.

First moment

Productive form or producer who owns 67 hectares of Category III land; of these, 30 hectares have been qualified as idle, according to notification received in July and with it the operating certificate. The tax is calculated as follows:

To determine the annual amount of the tax, it is necessary to multiply the amount of idle hectares by the amount established for each category (for category III it is $ 90.00), obtaining an annual amount of the tax of $ 2 700.00.

However, being the 1st year of application of the tax, only 5 months are paid, which are the remaining months after receiving the notification in July of the Certificate of Exploitation. Then, the proportional part of the tax is calculated for the remaining months (5 months: August-December). To do so, first the annual amount previously calculated is divided by the 12 months of the year, obtaining the monthly amount. Then it is multiplied by the remaining months of the year (5 months) obtaining the amount to be paid by the taxpayer for this tax, amounting to $ 1,125.00.

Payment must be made within 60 calendar days of receiving the notification in order not to pay late and to avoid being required to pay the corresponding late payment surcharge and a tax fine imposed by the National Tax Administration Office (Onat).

Second moment

Article 5, paragraph i) of Tax Law No. 113 refers to the Affidavit as follows:

The obligation of the taxpayer to declare the information required by law, in order to determine the amount to be paid for the tax, through the documents and forms established for such purposes by the Tax Administration, being obliged to the content and accuracy of the data contained therein and may be punished according to law, if not submitted or if it is submitted inaccurately, incomplete or fraudulent (National Assembly of People's Power, 2012, p. 1694)

It also adds in its article 35, that this must be submitted by the taxpayer at the closing of the liquidation through the model established by the Onat (National Assembly of People's Power, 2012, p. 1698).

How are the calculations made to fill out the Affidavit?

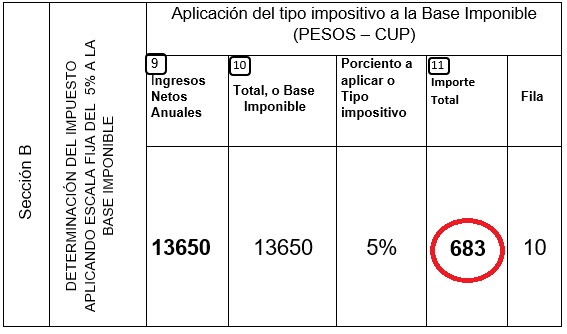

In order to calculate and fill out the Affidavit (Fig. 1 and 2), a logical sequence of steps must be followed, as follows:

Fig. 1 - Determination of taxable income

Source: Official model of the National Tax Administration Office

Fig. 2 - Application of the tax rate to the taxable base

Source: Official model of the National Tax Administration Office

Description of study material

It is known that there are hundreds of tools created with the purpose of providing a good learning experience to the student; in the case of teachers, they are helpful to foster collaboration and facilitate communication between them and the students, which is one of their main objectives, to help the educator.

In order to develop the tax culture on issues related to the payment of taxes in the cooperative sector, the study material was chosen as a tool to facilitate the Teaching-Learning Process of the subject Financial Administration of the State. This material can be used as a basic and support tool, so that it contributes to make more efficient, improve and enhance the teaching-educational process, as long as it has an objective focused on the subject and covers all the other aspects that should be considered when developing and/or using it (objectives, contents, student's characteristics and context). Its main purpose is to support the teacher in instruction and teaching and the student in learning, helping him/her to understand, assimilate and concretize the necessary information; therefore, it becomes a significant resource for the process.

According to Prendes, Martínez and Gutiérrez (2008), in order to elaborate this type of materials, several fundamental elements must be taken into account, among which are the organization of the information (how the contents are organized, order and coherence, complementary resources to the contents, clarity and precision) and the motivational aspects (strategies that encourage the motivation of students to facilitate their learning process).

The aforementioned criteria have been taken into account as fundamental references for the elaboration of the material proposed as a solution to the problem to be solved in this research. It was elaborated through a long research process, as well as the synthesis, elaboration and presentation of the contents demanded by the program of the subject. Its presentation is given as follows: brief introduction about the subject and its didactic structure (i.e. general objective, general content, work methodology, evaluation criteria and instruments, and didactic resources), self-diagnosis activities, content development based on a detailed analysis of the content, summary of the analysis, learning activities (derived from the previous analysis of the content from which the most appropriate activities to achieve significant and lasting learning can be derived), self-assessment activities, reference materials, glossary of key terms, sources of information (basic and complementary bibliography) and finally the annexes (including the answer key so that students can check their results).

On the other hand, three key aspects have been taken into account to ensure its relevance: first, that the material deals with topics of interest to the student; second, that it deals with the reality outside the classroom; and third, that it deals with something that will be useful for his or her future professional performance.

It is intended to cover the following knowledge system:

Given the nature of the proposed study material, it is included within the system of pedagogical means, thus facilitating the PEA of the subject Financial Administration and, with it, the mastery of the knowledge system, the acquisition of skills and abilities and the formation of attitudes and values in students.

In relation to the above, it is known, according to Gámez, González, Ojeda and Romero (2017, p. 248), "that the pedagogical means not only contribute to make the knowledge learned more durable, but also increase the motivation for teaching and for the subject in particular"; hence, then, the importance of having the appropriate material according to the situation deserves it.

Consistent with the previous approaches, it is considered that for a study material to be effective in achieving learning, it is not enough that it is a good material, it must also be considered to what extent its specific characteristics (contents, activities) are in line with certain aspects related, in this particular case, to the cooperative sector and its tax regime.

Assessment by specialist criteria

For the theoretical validity of the study material, the Specialist Criteria method was used to assess its pertinence in the context in which it is developed.

Criteria for the selection of specialists:

Thirty-five specialists were selected, according to the established criteria, which are composed by:

The specialists were provided with the proposed material for their assessment in terms of the following aspects:

In order to collect the criteria of the specialists, a survey was applied to evaluate the aspects mentioned above and to suggest considerations on the proposed study material. The evaluation categories proposed are as follows: Very Adequate (VA); Adequate (A); Poorly Adequate (PA).

After the survey was applied, the information obtained was processed and the median of each aspect, the absolute and relative frequency were determined, which led to the following results:

The 57 % (20) of the specialists consider its substantiation very adequate, as well as its relation with the evaluable object, meanwhile, 43 % (15) evaluate it of (A).

With respect to the specialists' appreciation of the general objective proposed, 66% (23) of them consider it very adequate and the remaining 12 evaluate it as adequate, which represents 34%.

Regarding the structural conception of the study material, 63% (22) considered it very adequate and only 37% (13) considered it adequate.

Regarding the pertinence and actuality of the knowledge system to be worked on, it was evaluated with category (VA), by 69 % (24) of the specialists. The rest evaluated this aspect as (A).

The 71 % (25) of the specialists rated the proposed learning activities as very adequate and the remaining 29% (10) considered them adequate.

The pertinence of the evaluation proposed for the study material was one of the best evaluated aspects with 83% (29) of the specialists; they consider the pertinence of the evaluation very adequate and only 17% (6) evaluate this aspect as adequate.

With regard to the considerations, in general terms:

The 100 % (35) of the specialists consider that the proposed study material meets the current needs of the country and of Technical and Professional Education and contributes to develop the tax culture from the cooperative sector in students. The proposal adjusts and contributes to the strengthening of the transformations taking place in the country.

The 98 % of the specialists consider that it may contribute to the development of learning levels and thus to the students' tax culture. However, it is a generalized opinion of the specialists that a preparation and training process should be developed for all the people involved in the development of the study material proposed as a result of the research, so that it may be satisfactorily applied.

The 94% of those interviewed consider the different exercises proposed in the material to be very useful and sufficient and recognize the importance of promoting the development of the tax culture from the cooperative sector.

Introduction of study material in pedagogical practice

The implementation of the study material was carried out by means of the experimental method, in its pre-experiment variant. In its development, one of the variants proposed by Hernández, Fernández and Baptista (2010) for this type of experiment was followed, which consists of the implementation of the proposal to a single experimental group and the application of a final measurement to observe the level of the group.

This variant of the experimental method was chosen because these contents are new for the students from the point of view of their purpose and depth. In order to evaluate the effectiveness of the proposal, the aspects of conscious assimilation used in the ascertainment of the problem are considered.

The pre-experiment worked with the third year of the Bachelor's Degree in Economics Education at the University of Pinar del Río, in the 2018-2019 school year. For the application of the pre-experiment, the input and output instruments, the variable to be transformed, the indicators and the valuation scale for them are taken into account.

With the pre-experiment, the variable under study is assessed: the development of tax culture in the topics of payment of taxes of the cooperative sector in the subject Financial Administration of the State. From this experimental design, the independent variable is the study material and the instruments used are the same, both for the pretest and the posttest.

To obtain the results of the practical validity from the pre-experiment, it was necessary to analyze and compare the results obtained from the application of the instruments before and after the implementation of the study material (pretest and posttest).

First the results of the pretest and then those of the posttest are analyzed and then a comparison is made between them, assessing the changes and transformations caused by the implementation of the study material.

Considering that the first phase of the pre-experiment coincides in the same time in which the diagnosis of the current state of the problem under research was developed and that the subjects are the same since the study is developed in the same school year, the analysis of the results of the diagnosis of the current state of the problem, previously reflected as the official results of the pretest, is recognized.

The second phase of the pre-experiment (posttest) was developed after the implementation of the study material. In this phase, indicators are established to measure their behavior with the different instruments at different moments of the process. For this purpose, the following rating scale was used for the positive frequencies (Table 1).

Table 1 - Assessment scale for positive frequencies

Scale |

Assessment |

[0-20 points] |

Very low |

[20-60 points] |

Low |

[60-80 points] |

Medium |

[80-95 points] |

High |

[95-100 points] |

Very high |

Source: Own elaboration

Subsequently, a new pedagogical test was applied, where the same knowledge elements were evaluated as in the initial pedagogical test. The same is done in a teaching way, applying the pre-experiment since an initial diagnosis is made where the problems that affect the learning of the students who are part of the selected sample are determined, specifically in the contents related to the calculation of taxes in the cooperative sector and an exit diagnosis where the results obtained after applying the proposed scientific result are evidenced.

It was possible to verify the level of effectiveness of the study material prepared to promote the development of the tax culture. These elements show that out of the 25 (100 %) students of the population, there is no one with a very low level, however, 4 % (1) of the students reach the low level since they do not manage to develop the skill; 20 % (5) of the students are in the medium level; 32 % (8) in the high level and the other 44 % (11) reach the very high level, i.e., without difficulty in demonstrating that they have the skill overcome since they achieve the development of the object of study.

The results obtained with the validation of the elaborated proposal allowed confirming its level of effectiveness to develop the tax culture, taking into account the conditions in which it was applied.

When establishing the comparative status of the results, it was possible to state that the implementation of the study material contributes to raise the level of development of the tax culture, since the students acquired knowledge, skills and values about it. This will allow them to operate in their future professional performance with a more integrative, coherent and systematic performance in this sense, which influences not only in the transformation of the state of the problem in the students but also in the professional performance contexts in which they will be inserted.

REFERENCES

Armas, M. E., & Colmenares de Eizaga, M. (2009). Educación para el desarrollo de la cultura tributaria. REDHECS: Revista electrónica de Humanidades, Educación y Comunicación Social, 6(4), 123-142. http://ojs.urbe.edu/index.php/redhecs/article/view/73

Bonilla Sebá, E. C. (2014). La cultura tributaria como herramienta de política fiscal: La experiencia de Bogotá. Revista Ciudades, Estados y Política, 1(1), 21-35. https://revistas.unal.edu.co/index.php/revcep/article/view/44456

Castro Borrero, J. (2012). Régimen tributario del sector cooperativo. Económicas CUC, 33(1), 265-282. https://revistascientificas.cuc.edu.co/economicascuc/article/view/191

Council of State of the Republic of Cuba. (2019). Decreto Ley No. 366 De las Cooperativas No Agropecuarias. Gaceta Oficial de la República de Cuba, Edición Ordinaria No. 63. https://www.gacetaoficial.gob.cu/es/decreto-ley-366-de-2019-de-consejo-de-estado

Crespo García, M. K., Carvallo Monsalve, Y. E., & Farinango Salazar, R. A. (2019). La Cultura Tributaria y su influencia en los Núcleos de Apoyo Contables y Fiscales de Machala-Ecuador. Revista Científica Agroecosistemas, 7(1), 119-124. https://aes.ucf.edu.cu/index.php/aes/article/view/252

Díaz Navarro, J. C., Cruz Vargas, B. G., & Castillo Castro, N. R. (2017). Cultura Tributaria. Revista Publicando, 3(9), 697-705. https://revistapublicando.org/revista/index.php/crv/article/view/403

Fucac. (2015). Manual de educación e integración cooperativa. Federación Uruguaya de Cooperativas de Ahorro y Crédito. http://fucac.dev.agile-cms.com/Content/Articles/75c4cf58-1e6a-43aa-9f58-87838a2eac36/Manual%20de%20Educaci%C3%B3n%20e%20Integraci%C3%B3n%20Cooperativa%2025-09.pdf

Gamboa, J., Hurtado, J., & Ortiz, G. (2017). Gestión de la política fiscal para fortalecer la cultura tributaria en Ecuador. Revista Publicando, 4(10 (2)), 448-461. https://revistapublicando.org/revista/index.php/crv/article/view/506

Gámez Iglesias, A., González Montpellier, L. E., Ojeda Mesa, L., & Romero Sosa, M. L. (2017). Implementación de un material de estudio para la cultura económica sobre temas de educación cooperativa. Cooperativismo y Desarrollo, 5(2), 241-251. https://coodes.upr.edu.cu/index.php/coodes/article/view/177

García Pedraza, L., García Ruiz, J. G., & Figueras Matos, D. (2018). Importancia de la educación cooperativa. Una experiencia cubana. REVESCO. Revista de Estudios Cooperativos, 129, 142-160. https://doi.org/10.5209/REVE.62881

Hernández Sampieri, R., Fernández Coliado, C., & Baptista, P. (2010). Metodología de la investigación. McGraw-Hill.

Mendoza Shaw, F. A., Palomino Cano, R., Robles Encinas, J. E., & Ramírez Guardado, S. R. (2016). Correlación entre cultura tributaria y educación tributaria universitaria: Caso Universidad Estatal De Sonora. Revista Global de Negocios, 4(1), 61-76. https://www.theibfr.com/wpfb-file/rgn-v4n1-2016-5-pdf

National Assembly of People's Power. (2012). Ley 113 Sistema Tributario de Cuba. Gaceta Oficial de la República de Cuba, Edición Ordinaria No. 53. https://www.gacetaoficial.gob.cu/es/ley-113-de-2012-de-asamblea-nacional-del-poder-popular

Neira Galván, M. I. (2019). La cultura tributaria en la recaudación de los tributos. Polo del Conocimiento, 4(8), 203-212. https://doi.org/10.23857/pc.v4i8.1055

Onei. (2020). Organización Institucional. Principales entidades. Oficina Nacional de Estadística e Información. http://www.onei.gob.cu/node/14973

Padrón Carmona, L. (2015). La orientación al marketing como vía para fortalecer la gestión comercial de la empresa cooperativa. Cooperativismo y Desarrollo, 3(2), 160-167. https://coodes.upr.edu.cu/index.php/coodes/article/view/106

PCC. (2017). Lineamientos de la Política Económica y Social del Partido y la Revolución para el período 2016-2021. Partido Comunista de Cuba. VII Congreso. http://www.granma.cu/file/pdf/gaceta/Lineamientos%202016-2021%20Versi%C3%B3n%20Final.pdf

Prendes Espinosa, M. P., Martínez Sánchez, F., & Gutiérrez Porlán, I. (2008). Producción de material didáctico: Los objetos de aprendizaje. RIED. Revista Iberoamericana de Educación a Distancia, 11(1), 80-106. https://doi.org/10.5944/ried.1.11.957

Quispe Fernández, G. M., Arellano Cepeda, O. E., Rodríguez, E. A., Negrete Costales, O. P., & Vélez Hidalgo, K. G. (2019). Las reformas tributarias en el Ecuador. Análisis del periodo 1492 a 2015. Revista ESPACIOS, 40(13). https://www.revistaespacios.com/a19v40n13/19401321.html

Sarduy González, M., & Gancedo Gaspar, I. (2016). La cultura tributaria en la sociedad cubana: Un problema a resolver. Cofín Habana, 10(1), 126-141. http://www.cofinhab.uh.cu/index.php/RCCF/article/view/182

Conflict of interest:

Authors declare not to have any conflict of interest.

Authors' contribution:

All authors reviewed the writing of the manuscript and approve the version finally submitted.