0000-0003-0048-8395

0000-0003-0048-8395  rcapote@upr.edu.cu

rcapote@upr.edu.cuCarlos Cesar Torres Paez1

0000-0001-7956-5079

0000-0001-7956-5079  carlosc@upr.edu.cu

carlosc@upr.edu.cuLuis del Castillo Sánchez2

0000-0003-4476-331X

0000-0003-4476-331X  luiqui@fec.uh.cu

luiqui@fec.uh.cu

Cooperativismo y Desarrollo, September-December 2022; 10(3), 653-678

Translated from the original in Spanish

Original article

Model for the management of local development financing at the municipal level in Cuba

Modelo para la gestión del financiamiento del desarrollo local a escala municipal en Cuba

Modelo para a gestão do financiamento do desenvolvimento local a nível municipal em Cuba

Raysa Capote Pérez1  0000-0003-0048-8395

0000-0003-0048-8395  rcapote@upr.edu.cu

rcapote@upr.edu.cu

Carlos Cesar Torres Paez1  0000-0001-7956-5079

0000-0001-7956-5079  carlosc@upr.edu.cu

carlosc@upr.edu.cu

Luis del Castillo Sánchez2  0000-0003-4476-331X

0000-0003-4476-331X  luiqui@fec.uh.cu

luiqui@fec.uh.cu

1 University of Pinar del Río

"Hermanos Saíz Montes de Oca". Faculty of Economic Sciences. Center of Studies for Management, Local Development, Tourism and Cooperativism (CE-GESTA).

Pinar del Río, Cuba.

2 University of Havana. Havana, Cuba.

Received: 8/11/2022

Accepted: 28/11/2022

ABSTRACT

Studies on the management of local development financing show that there is no model that integrates the different conceptual areas and territorial planning tools involved, from a sustainable approach and with the protagonist coordination of local governments and public administrations. This topic is of special interest for Cuba, which in the updating of its economic and social development model encourages local structures to self-manage their development. The objective of this research is to design a model for the management of local development financing at the municipal level, which contributes to the use of endogenous and exogenous resources. The fundamental stages of the management process are presented, the components of the model, the fundamental relationships and the procedure for its implementation are explained. To this end, participatory workshops were held and the analysis and synthesis method was used. The proposed model orients actions towards the articulation of the actors involved in the process, in order to respond to the demands of local development, making efficient use of endogenous and exogenous resources.

Keywords: model; management; financing.

RESUMEN

En los estudios sobre gestión del financiamiento del desarrollo local, se constata que no existe un modelo que integre las diferentes áreas conceptuales y herramientas de planificación territorial que en él intervienen, desde un enfoque sostenible y con la coordinación protagónica de los gobiernos y administraciones públicas locales. Especial interés adquiere el tema para Cuba que en la actualización de su modelo de desarrollo económico y social fomenta en las estructuras locales la autogestión de su desarrollo. La presente investigación tiene como objetivo diseñar un modelo para la gestión del financiamiento del desarrollo local a escala municipal, que contribuya al aprovechamiento de recursos endógenos y exógenos. Se presentan las etapas fundamentales del proceso de gestión, se explican los componentes del modelo, las relaciones fundamentales y el procedimiento para su implementación. Para ello se realizaron talleres participativos y se utilizó el método de análisis y síntesis. El modelo que se propone orienta las acciones hacia la articulación de los actores que intervienen en el proceso, en función de responder a las demandas del desarrollo local, realizando un uso eficiente de los recursos endógenos y exógenos.

Palabras clave: modelo; gestión; financiamiento.

RESUMO

Em estudos sobre a gestão do financiamento do desenvolvimento local, notou-se que não existe um modelo que integre as diferentes áreas conceptuais e instrumentos de planejamento territorial envolvidos, a partir de uma abordagem sustentável e com a coordenação protagonista dos governos locais e das administrações públicas. O tema é de particular interesse para Cuba, que na atualização do seu modelo de desenvolvimento económico e social incentiva as estruturas locais a autogerirem o seu desenvolvimento. O objetivo desta investigação é conceber um modelo para a gestão do financiamento do desenvolvimento local a nível municipal, que contribua para a utilização de recursos endógenos e exógenos. Apresenta as fases fundamentais do processo de gestão, explica as componentes do modelo, as relações fundamentais e o procedimento para a sua implementação. Para este fim foram realizadas jornadas participativas e foi utilizado o método de análise e síntese. O modelo proposto orienta as ações para a articulação dos atores envolvidos no processo, a fim de responder às exigências do desenvolvimento local, fazendo uma utilização eficiente dos recursos endógenos e exógenos.

Palavras-chave: modelo; gestão; financiamento.

INTRODUCTION

In Cuba, with the process of updating its economic and social model, the aim is to "promote the development of the territories based on the country's strategy, so that the municipalities are strengthened as a fundamental instance, with the necessary autonomy, sustainable, with a solid economic-productive base and the main disproportions between these are reduced, taking advantage of their potential" (PCC, 2017, Guideline 17).

With this objective in mind, it is been working on the implementation of tools to improve public management at the municipal level, so that they can make use, in a coordinated and efficient manner, of the autonomy and competencies attributed to them as a result of the decentralization process that is beginning to become evident in the country. These processes of municipal self-management are improved through the design of their strategies, which must be in correspondence with those of the province and the country, contributing to take advantage of endogenous and exogenous resources, and to the inter-agency, inter-territorial and multilevel articulation.

Taking into account the systematization of a series of works of authors such as: Capote Pérez et al. (2018), Almaguer Torres et al. (2020), Díaz-Canel Bermúdez et al. (2020), as well as from reports of workshops conducted by the National Network of University Management of Knowledge and Innovation for Development, there are identified regularities on the existing limitations for the management of local development by municipal governments that hinder the coordinated development of the process, including: 1) insufficient coordination and effective integration between organizations and institutions involved in the process of elaboration of plans for the economy; 2) excessive centralization in decision-making and resource management; 3) the local actor is characterized more as a recipient than as a protagonist of its development; 4) limited incorporation of the population as an active subject in the management of local development, as well as of non-state forms of management and their integration with state ones based on productive and value chains; 5) insufficient funding for the development of the programs and projects designed.

Regarding this last element, it should be noted that financing is a concept that is becoming increasingly popular and has been widely analyzed, but basically it is based on a single idea, which consists of obtaining financial resources, in any form, allowing the small entrepreneur to obtain the necessary capital to carry out his operations and thus improve the situation of his business (Gascón González et al., 2021).

Local development management should adopt a combination of process and system approaches. Understanding and managing interrelated processes as a system contributes to the efficiency and effectiveness of local development management, in terms of achieving the expected results.

Financial management represents a process within local development management that brings together knowledge, skills and methods that determine the levels of financial resources mobilized. This process must incorporate the management cycle (plan, organize, implement and control) to ensure that the other processes are adequately resourced and managed, helping to avoid non-compliance with planned results.

Taking into account the criteria of Vega Campos et al. (2019) when addressing issues of financing for local development, it must be gone beyond the enumeration and description of instruments, both for the approach adopted, as well as for the analysis of the weaknesses and strengths of the mechanisms or for the recommendations to successfully design and implement new financing systems.

Within any development strategy, the management of financing at the local level constitutes a fundamental element to be considered, not only because of its scarcity, but also because of the need for efficient and timely administration of existing ones, so it is necessary to stimulate the creation of funds for investment, accompanied by the use of internal sources and access to favorable external financing conditions that through a process of effective analysis and control facilitate local government decision-making in terms of investment for development, according to authors such as (Morais Mulaza et al., 2019).

Because of their theoretical significance, the most representative alternatives in the management of financing for these purposes in Cuba and referenced, according to the specialized literature consulted by the authors, can be pointed out as the most representative alternatives in the management of financing for these purposes in Cuba and referenced, according to the specialized literature consulted by the authors, the following: Financial planning procedure for the requirements of the municipal development strategy (Traba Ravelo, 2014), General procedure for the management of local development project financing (Hassan Marrero et al., 2015), Financial management procedure designed for local development (Rivera García & del Pozo Álvarez, 2016) and Procedure for the management of the local development financing process (Capote Pérez & Torres Paez, 2016).

The four alternatives are innovative proposals that set guidelines for the management of financing to meet the demands of local development, adapted to the characteristics of the localities in which they are implemented. However, they fail to represent how the local development financing process should be managed, nor do they establish when, how, under what principles and under what regularities such management should be carried out.

Based on the above, the authors of this article aim to propose a model for the management of the local development financing process, which will be based on certain essential relationships that reinforce it theoretically and are structured on the basis of the identification of: objective, premises, principles, approaches, fundamental stages, frontiers and elements prior to the management of the local development financing process. Its implementation requires a procedure that responds to the requirements and particularities of the process.

MATERIALS AND METHODS

During the research, the dialectical-materialist method was applied as the general method of Marxist political economy and from which all the others are derived. This method allowed guiding the exploration of new regularities, functions and structures in the research object and field of action previously identified.

Theoretical methods

Historical and logical method: it was used to determine the trends in the management of local development financing from the municipal public administration, based on the models, procedures and mechanisms that precede the proposal of this research. Its application made it possible to recognize national and international experiences on the subject and to analyze their theoretical and methodological contributions and the main limitations that underlie the need for the theoretical and methodological contributions of this research.

Systemic method: it was used to support the model for the management of local development financing at the municipal level.

Modeling method: it was used to support and structure the artificial representation of the model for the management of local development financing at the municipal level, as well as the procedure for its implementation.

Associated with the theoretical and practical methods, the following procedures were used: Analysis and synthesis: used for the decomposition of the functioning of the object into its various components and the establishment of the relationships between them. The starting point was to take the totality of the management of local development financing and mentally break it down into its component parts, namely the levels of planning, organization, implementation and evaluation at the municipal level. Subsequently, these component parts were investigated in their reciprocal relationship, which helped to reveal the dialectical contradiction that arises and the way to resolve it. It is concluded with the synthesis that was in charge of mentally recomposing the totality with the new qualities and regularities that govern its functioning and that sustain the theoretical contribution of the research presented. In a general sense, it made it possible to internalize the essence of each of the parts that make up the proposed model and procedure.

RESULTS AND DISCUSSION

Methodological tools for financing local development

The local development approach, due to its dynamism in recent times, has demanded greater planning from local actors in order to promote coherent strategies to achieve the objectives, both those that respond to national interests and local priorities. The municipal government, through the administration, is called upon to lead these goals, taking into account its proximity to citizens. For the fulfillment of planning, it is necessary to resort to budgets that involve programs and projects, an aspect that in many cases limits economic development, due to the insufficiencies of the national financial system and the insufficient management of financing at the municipal level.

In the literature review, which is carried out not only by analyzing each experience in depth, but also by searching for the distinctive elements of each one of them, no single model of financing management for local development has been identified. There are different methodological tools expressed in instruments, schemes or procedures aimed at meeting the financial demands of local initiatives.

Due to their theoretical significance, the most representative alternatives in financing for these purposes and referenced according to the specialized literature consulted by the authors can be pointed out as the most representative alternatives, the following at the international level: microfinance program (MP) in Bangladesh (Gutiérrez Goiria, 2011); participatory budgeting (PB) in Latin America (Pineda Nebot et al., 2021), decentralization scheme (ED) in Latin America (Batallas Gómez, 2013). At the national level: procedure for the financial planning of the demands of municipal development strategies (PFDEDM) (Traba Ravelo, 2014), general procedure for the financing of local development projects (PGFPDL) (Hassan Marrero et al., 2015), scheme for the management of local development financing (EGFDL) (Rivera García & del Pozo Álvarez, 2016).

The review and comparison of the aforementioned methodological tools were carried out taking into account the following criteria: 1) the environment in which the experiences are developed; 2) the objective pursued; 3) the figure that leads the financing; 4) the actors involved, either as beneficiaries or as participants; 5) the stages that mark the financing of development; 6) the methodological contributions that serve as a reference for the proposal of this research; and 7) the main limitations.

The study of the tools allowed to identify the following points of agreement: 1) they all consider the financing of projects arising from local initiatives as the axis of impact; 2) they assume working directly at a micro level and mobilizing local resources, with a view to sustainability; 3) they recognize the importance of citizen participation in the management of local development.

The microfinance Program in Bangladesh and participatory budgeting in Latin America are instruments at the service of citizens, sectors and regions that traditional banks are unwilling or unable to finance. These, like the decentralization scheme in Latin America, can efficiently contribute to political and social welfare objectives through job creation, reduction of social exclusion and regeneration of the local economy.

In the case of participatory budgets, they represent an instrument of the new governance, through which the decision of where budgets are allocated is democratized. The peculiarity of participatory budgets is the possibility of increasing the number of actors involved in the decision-making process regarding the allocation of resources, which has an impact on the democratization, transparency and maximization of public resources. This last aspect is achieved not only by improving the quality of spending, attending to projects of general interest that seek to have an impact on the living conditions of the population, but also by requiring a counterpart of resources from the beneficiaries.

Research from the national context that proposes tools associated with the financing management process fails to integrate in a coordinated manner the stages of planning, organization, implementation, and control and evaluation.

Only the PFDEDM and the PGFPDL propose stages and steps as critical routes for this management process. It is worth noting that the PFDEDM proposes a detailed procedure for financial planning of the demands of municipal development strategies, highlighting, among other factors, the need to project the sources that can be used for these purposes.

In the opinion of the authors, the limitations of these tools, which constitute references for the proposal of this research, are the following:

The approaches analyzed above provide new learning elements with which to build concrete proposals from the particular context of Cuba, allowing the practical and efficient implementation of the management of the financing process in municipal spaces and with a focus on sustainability. However, they lack the "how" this management should be carried out, since, in general, they are limited to the allocation of financial resources to economic-productive projects or to the improvement of public services.

The foregoing supports the need to build a proposal threading together the particular Cuban context and the international and national theoretical and methodological lessons learned.

Management of the local development financing process

The transformations of the world economy, characterized by the economic and financial crisis that causes scarcity of resources, unemployment and recession, require more efficiency in the management of competitiveness, both of private enterprise and public institutions, and the social commitment of their citizens. To this end, social and economic policies must be focused on addressing complex social problems (ECLAC, 2022).

It is vitally important to move towards an inclusive, integrated financial system oriented toward supporting local initiatives, which implies complementing the facilitation of financing alternatives with improvements for investments and incentives for innovation and the incorporation of technologies to reduce production and business gaps.

The management of financing at the local level is a fundamental element to be considered in any development strategy, not only because of its scarcity, but also because of the need for efficient and timely administration of existing funds.

For this reason, it is necessary to stimulate the creation of funds for investment, accompanied by the use of internal sources and access to favorable external financing conditions that, through a process of effective analysis and control, facilitate local government decision making in terms of investment for development.

The financial management of local development includes the management of financial monetary resources to carry out an economic activity in a specific locality, with the characteristic that it generally involves sums borrowed that are complemented with own resources. This includes own sources of financing and to credits with the objective of ordering and hierarchizing inputs and contributions according to the criteria of: integrality, relevance and flexibility (Rivera García & del Pozo Álvarez, 2016).

On the other hand, López Carriel et al. (2021) argue that financial management at the local level arises as a consequence of the existence of operational flows, both of a budgetary and extra-budgetary nature, and of the existence of financial flows, a consequence of the investment and financing needs of local entities. As common elements of these approaches, the following can be identified:

In the bibliography to which access was obtained, there are few references related to the management of local development financing, which shows that this process is not understood as a whole from the management cycle in order to efficiently meet the financial demands of local development management.

The authors define local development finance management as a participatory, inter actors and multilevel process through which the public administration, based on its competencies and capacities, plans, organizes, implements, monitors and evaluates the financing of local development projects, based on the use of endogenous and exogenous resources.

In this concept, the following are established as fundamental ideas:

The development of this management, from the municipal public administration, facilitates, in the authors' opinion, the management of local development, since it increases the capacity for action of public actors, since it provides them with tools that enable them to manage sources of financing according to their needs and the full development of their potential.

Based on the above, it can be affirmed that the capacity of local economic actors to undertake any development strategy will depend, to a large extent, on the availability of financial resources and the possibility of accessing them in a timely manner. For which, according to Traba Ravelo (2014) and Cornejo Saavedra and Sánchez Dávila (2021), financial planning becomes an essential component in local development planning, making it possible to mitigate the effects of financial uncertainty in local spaces.

In order to carry out the financial planning process, it is essential to identify and study the different sources available in the municipality to finance its projects before making any investment decision.

The consequences of using one or another financing alternative must be considered for each project, obviously taking into account both the availability of resources and the expected economic returns of the project. The different financing modalities have their own characteristics and usually have different effects on the different stages of the project.

It is vitally important in local development finance management to constantly review each stage of the process to assess progress and determine whether the objectives are being met. Based on this review, it can be determined whether to continue implementing the planned actions as is, or whether they need to be revised and adjusted for internal and external conditions that influence their implementation.

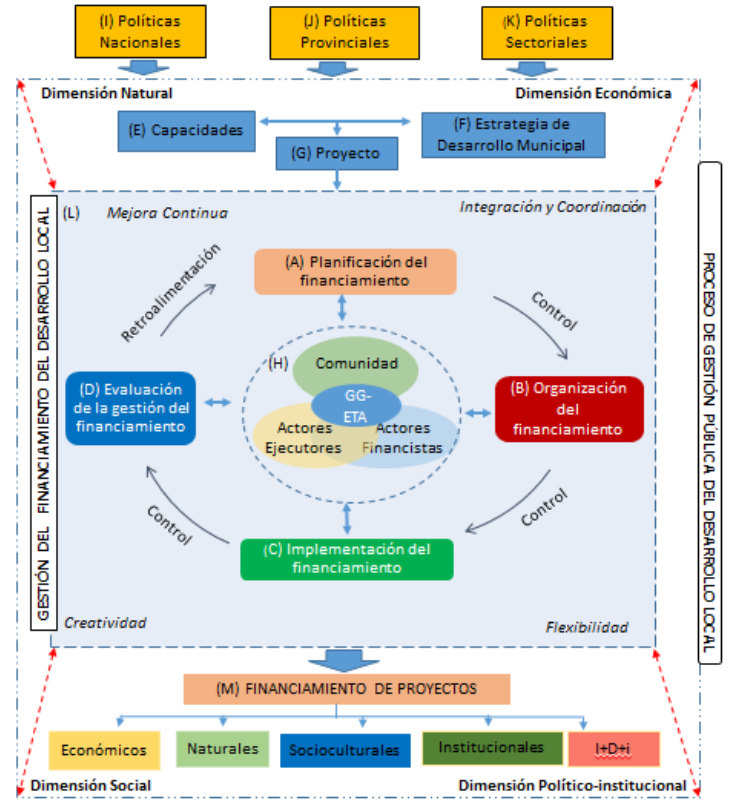

The model proposed in figure 1 is a representation of the relationships established between the different components that comprise it, forming an orderly and coherent whole, in which the management of the local development financing process is carried out by the municipal public administration. The objective is to contribute to the promotion of local development projects through the integral and participatory management of their financing, enhancing the value of endogenous and exogenous resources by state and non-state actors.

Fig. 1 - Model for the Management of Local Development Financing Processes

Source: Prepared by the authors

It takes into account a sustainable financial self-management approach, as it is aimed at ensuring the necessary financial resources from the local public administration for the local development management process, based on the continuous learning and application of financing management mechanisms and tools that integrate all sources of financing, based on the enhancement of endogenous resources, through local development projects, driven by the management process itself. This should be done on a sustainable basis, so that financial resources are available over time and their use has a balanced impact on each of the dimensions of development. On the other hand, in the conception of local development projects -which impulse is the main objective of the model- different stages are considered for their preparation and the sustainability of the projects over time depends on the effective achievement of the objectives of each one of them.

Three premises are defined for the application of the model, which represent indispensable requirements, among them, to be a municipality with financial autonomy, an element that makes it possible to have the independence for the creation, determination, collection and investment of financial resources, as well as their management through the preparation of the budget, always focused on the satisfaction of government expenditures and the local needs of society. Another premise is the willingness of the local government to apply the procedure that accompanies the proposed model and, as a third premise, to have development strategies designed in the territory that establish priorities in terms of policies, lines, programs and projects in correspondence with the planned objectives.

The municipality, in the management of the local development financing process, is affected by macro-environmental factors or variables of the border component that are in permanent interaction with the process itself and that constitute support elements for its operation, such as: national, provincial and sectoral policies.

Identifying and evaluating these factors is of vital importance in the management of the local development financing process, since it is they that determine municipal competencies with respect to financing management, set the trends in the use of financing sources in certain periods of time, taking into account the priorities, strategies, programs and projects established by the management of the country and provincial governments. In addition, they regulate the relationships that can be established between the different actors at each level, in a social and participatory context, which influences the functioning and efficiency of the proposed model; policies whether national, provincial or branch and sectoral influence the functioning of the entities and determine the relationships that have a presence in the municipality, as well as its economic, social, natural and political-institutional development.

Parallel to the assessment of boundary variables and as elements prior to the financing management process, the capacities (translated into knowledge, skills, aptitudes and techniques) of local actors in terms of local development management and the demands for financing for their construction should be analyzed first. It should be borne in mind that capacity building is an integral part of local development and not an element to support its management.

Another prior element to be assumed as a working tool is the local development strategy, in which policies, lines and programs are designed, taking into account their potential and limitations, and which, for their design and materialization, through local development projects, require financing to achieve the planned objectives.

The model considers the management of the local development financing process as an essential component, which is framed in a process that includes a basic cycle that goes through financing planning, design of financing mechanisms, implementation, evaluation and feedback with a monitoring and control process that is permanent in all its stages.

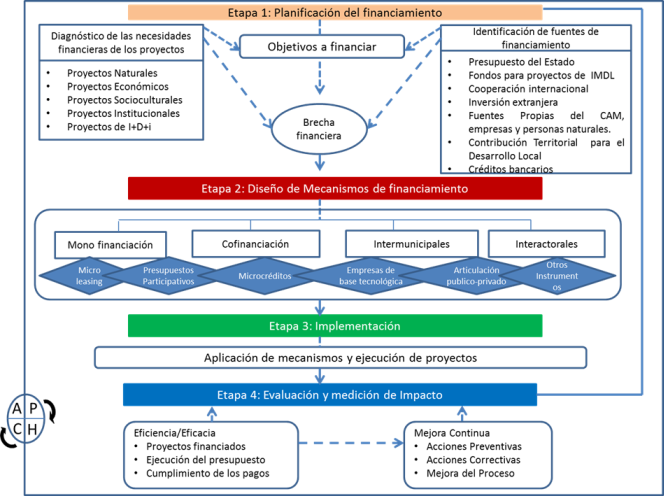

Stage 1. Financing planning

The objective of this phase is to identify the financing demands of local development projects and the sources of financing available to the municipality in order to identify the financial gaps.

For this purpose, the stages for the design and implementation of projects and the typology of local development projects (economic, sociocultural, natural, institutional and research, development and innovation) will be taken into account. On the other hand, the projections of each of the sources of financing, the use that can be made of them and the objectives they pursue will be evaluated. This will make it possible to define the projects to be financed in stages.

Stage 2. Design of financing mechanisms

Based on the results of the previous phase, the mechanisms to be used are designed, the relationships to be established and the responsibilities and tasks of each actor involved are defined in order to cover as much financial demand as possible.

Stage 3. Implementation

This basically refers to the process in which the financing assigned to the projects is delivered and executed, taking into account that this delivery, depending on the characteristics of the project, may be made according to the stages of development of the project.

Stage 4. Impact evaluation and measurement

The management of the financing process and its impact on the projects financed is evaluated. All this is done through the permanent monitoring and control of each of its phases, which allows for feedback and continuous improvement. By combining the phases of the process followed by the model, the scheme shown in figure 2 is obtained.

Fig. 2 - Schematic diagram

of the process underpinning the model for managing the local development financing process

Source: Prepared by the authors

In managing the process described above, the model involves the most influential actors, grouping them into three groups (1) Financiers, (2) Executors and (3) Community.

The financing actors include the business sector (state and non-state), municipal, provincial and national governments, cooperation agencies, foreign investors, research centers, among others that have capital to invest in local development projects that respond to their interests.

On the other hand, the executing actors establish the demands for financial resources to be able to develop some of the stages of their project; these may be (state or non-state enterprises, non-profit organizations among which are included: civil society organizations with legal recognition (such as professional organizations), mass organizations that characterize the Cuban social network and social agencies and institutions that, in general, are part of the budgeted public sector (say Education, Health, Culture, Sports), among others).

Finally, the community as the decisive actor, to which all efforts are directed. It participates in the design of projects, is a resource demander and is the recipient of the impacts of local development management, endorsing or rejecting the results.

The model conceives the presence and interaction of different types of ownership and management as should be characteristic in the socialist transition. The guiding role of the local government is recognized as the main client of the model, since it is the body that, based on decentralization processes and with certain competencies, which must be clearly defined, designs, coordinates and regulates local policies and strategies articulated with those of higher levels and, therefore, is vested with the highest authority to promote local development. The Municipal Administration Council leads the management process of local development financing, for which it is assisted by a Technical Advisory Team (ETA), made up of members of the Municipal Group of Local Development, under the supervision and control of the Municipal Assembly of People's Power.

The ETA should function as a strategic advisor to the Municipal Group for Local Development and as a body for coordination between interests and financing demands, in terms of local development. Within the ETA, ad hoc subgroups may be formed to enable the development of the different functions conferred upon it and thus be able to evaluate the best financing alternatives, as well as the specific requirements of project proposals and their consistency with the strategic lines of development of the municipality and the structure of programs that contribute to them, the articulation with supralocal interests and the more specialized technical aspects related to the feasibility of project implementation, among others.

It is important to note that the management of the financing process should be based on fundamental principles such as integration and coordination, continuous improvement, flexibility and creativity. The essential relationships in the model are defined below.

1. Environment-Local Development Public Management Process-Management of the local development financing process

The relationships between these components are based on the need to achieve a better linkage between the management of the local development financing process and the environmental factors that influence it, within the framework of a more global process such as the public management of local development.

The management of the local development financing process takes place in an increasingly dynamic environment, where the sources of financing vary and are limited and, on the other hand, the demands for financing are growing. This is why it becomes one of the determining factors in achieving transformations and adaptability to the conditions imposed by the environment.

It is within this framework that it is important for the management of the financing process to be developed taking into account the conditions imposed by the environment and, at the same time, transforming it. This will be achieved by helping to secure the necessary financial resources so that public management of local development will have a positive impact on the quality of life of the members of the locality.

2. Financing planning (inputs)-Design and implementation of financing mechanisms (transformation)-Evaluation (outputs) and measurement of the impact of financing management (outcomes)

Local development financing should be managed as a process, in an efficient, integrated and participatory manner as part of local development management, making optimal use of endogenous and exogenous resources.

When considering it in this way, it is essential to take into account the inputs, the mechanisms designed for the transformation process and the resulting outcomes and impacts, all as part of its management.

The planning phase provides a diagnosis of the financial demands of local development management, structured in the form of projects, and identifies the sources available in the municipality to meet these demands; the relationship between the two results defines the projects to be financed and the gaps based on unmet demands. We then proceed to design the financing mechanisms that can be used to cover the greatest amount of demand.

This interrelation between project, mechanism of/and financing allows the enhancement of endogenous and exogenous resources and the articulation between local actors, achieving certain results with their respective impacts. All this contributes to improve the process of public management of local development in the economic, socio-cultural, natural and political-institutional spheres, with its corresponding impact on the improvement of the population's quality of life.

3. Projects-Management of the local development financing process-Projects financed

It expresses the sequence to be followed from the design of local development projects until they are financed, including the management of their financing. It is important to consider the role played by project design in this essential relationship, since it is in this process that financing needs are diagnosed and, in addition, it contributes to materialize the actions to fulfill the strategic objectives.

In these relationships, actions are planned to bridge the existing financial gap, and provide community members and managers and workers in the state and non-state sectors with skills for managing local development.

4. Technical team advisor-Community-Executing actors-Investor actors

The importance assigned to the active participation of local stakeholders in the management of the local development financing process in its different stages is expressed. The success of the management process and the enhancement of endogenous and exogenous resources through the implementation of local development projects depend to a large extent on the links established among them.

It is a system or network of horizontal and vertical relationships between actors, which is expressed in the implementation of coordination mechanisms for the articulation of interests, optimization of management, conflict resolution, etc.

This system of relations implies the protagonism and collective leadership of the government management through the ETA to achieve the expected synergies in terms of the fulfillment of the objectives.

This model provides the conceptual framework for managing the local development financing process. For its application, a procedure is developed with the stages and steps to be followed. In its design, the criteria of the authors Hassan Marrero (2015), Rivera García and del Pozo Álvarez (2016) and Capote Pérez et al. (2018) were taken into account. A summary is shown in table 1 below.

Table 1 - General model and procedure for the management of the local development financing process

Management Model for the Local Development Financing Process (GEPROFIDL) |

||

Objective: Contribute to the promotion of local development projects through the integral and participatory management of their financing, enhancing the value of endogenous and exogenous resources by state and non-state actors. |

||

Approach: Sustainable financial self-management |

||

Premises |

||

|

||

Principles |

||

|

||

Borders |

Elements prior to the financing management process |

|

|

|

|

General procedure |

||

Stage I. Preliminary preparation |

Step 1 |

Evaluation of the legal regulatory framework for project financing. |

Step 2 |

Awareness raising and training. |

|

Step 3 |

Assessment of compliance with the premises. |

|

Stage II. Organization |

Step 4 |

Identification of the members of the Technical Advisory Teams. |

Step 5 |

Preparation of organizational and material conditions. |

|

Step 6 |

Approval of the implementation of the work procedure. |

|

Stage III. Identification and analysis of projects to be financed |

Step 7 |

Diagnosis of financing needs. |

Step 8 |

Identification of possible sources of financing |

|

Step 9 |

Selection of programs and projects to be financed and definition of financing mechanisms. |

|

Step 10 |

Approval of the proposal of projects to be financed and strategy to be used. |

|

Stage IV. Implementation |

Step 11 |

Transfer of resources to the executing entities of the selected projects. |

Step 12 |

Execution of the financing transferred to the executing entities. |

|

Step 13 |

Monitoring of the execution process of the funds transferred. |

|

Stage V. Evaluation and feedback |

Step 14 |

Definition of indicators for evaluation. |

Step 15 |

Execution of the evaluation. |

|

Step 16 |

Systematization of good practices and lessons learned and feedback. |

|

Step 17 |

Communication on the implementation process of the financed projects. |

|

Source: Prepared by the authors

The management of financing to meet the demands of local development is one of the most complex elements faced by local governments and, even more so, in the case of Cuba, taking into account its economic and social conditions. For this reason, decisions related to financing are of vital importance and compromise the efficient execution of planned actions within the strategic design of local development.

The proposed model is a representation of the relationships established between the different components that comprise it, forming an orderly and coherent whole, in which the management of the local development financing process is carried out by the municipal public administration. It orients the actions towards the articulation of the actors involved in the process, based on the efficient use of endogenous and exogenous resources to respond to the demands of local development management.

REFERENCES

Almaguer Torres, R. M., Pérez Campaña, M., & Aguilera García, L. O. (2020). Procedimiento para la gestión integrada y por procesos de proyectos de desarrollo local. Retos de la Dirección, 14(1), 89-114. https://revistas.reduc.edu.cu/index.php/retos/article/view/3369

Batallas Gómez, H. (2013). El actual modelo de descentralización en el Ecuador: Un desafío para los gobiernos autónomos descentralizados. Foro: Revista de Derecho, (20), 5-22. https://revistas.uasb.edu.ec/index.php/foro/article/view/424

Capote Pérez, R., & Torres Paez, C. C. (2016). La gestión del financiamiento en los procesos de desarrollo local. Revista Caribeña de Ciencias Sociales, abril. https://www.eumed.net/rev/caribe/2018/04/financiamiento-desarrollo-local.html

Capote Pérez, R., Torres Paez, C. C., & del Castillo Sánchez, L. (2018). Retos de la Administración Pública para la gestión del proceso de financiamiento del desarrollo local. Cooperativismo y Desarrollo, 6(2), 179-197. http://coodes.upr.edu.cu/index.php/coodes/article/view/206

Cepal. (2022). Cómo financiar el desarrollo sostenible: Recuperación de los efectos del COVID-19 en América Latina y el Caribe (Informe Especial COVID-19 N.o 13). Comisión Económica para América Latina y el Caribe. https://www.cepal.org/es/publicaciones/47720-como-financiar-desarrollo-sostenible-recuperacion-efectos-covid-19-america

Cornejo Saavedra, G. I., & Sánchez Dávila, K. (2021). La administración financiera municipal en el desarrollo local. Ciencia Latina Revista Científica Multidisciplinar, 5(5), 7974-7996. https://doi.org/10.37811/cl_rcm.v5i5.885

Díaz-Canel Bermúdez, M., Núñez Jover, J., & Torres Paez, C. C. (2020). Ciencia e innovación como pilar de la gestión de gobierno: Un camino hacia los sistemas alimentarios locales. Cooperativismo y Desarrollo, 8(3), 367-387. https://coodes.upr.edu.cu/index.php/coodes/article/view/372

Gascón González, D., Noa Guerra, D., & Viera Álvarez, S. (2021). Gestión de la contribución territorial como fuente de financiamiento del desarrollo local en el municipio cubano. Revista cubana de ciencias económicas, 7(1), 138-151. https://www.ekotemas.cu/index.php/ekotemas/article/view/169

Gutiérrez Goiria, J. (2011). Las microfinanzas en el marco de la financiación del desarrollo: Compatibilidad y/o conflicto entre objetivos sociales y financieros [Doctorado en Ciencias Económicas, Universidad del País Vasco]. https://addi.ehu.es/handle/10810/6872

Hassan Marrero, N., Pavón Hernández, A., Hernández Vega, A. E., & Balogun Arogunjo, E. B. (2015). Implementación de procedimiento para financiar el proyecto fortalecimiento de la gestión universitaria para el desarrollo local. Avanzada Científica, 18(1), 56-71. http://www.avanzada.idict.cu/index.php/avanzada/article/view/495

López Carriel, A. G., Guaño Gusqui, R. R., Sánchez Chávez, A. M., & Huerta Cruz, S. Y. (2021). Diseño de estrategias de gestión financiera para fortalecer el turismo en el cantón Salitre. Dominio de las Ciencias, 7(3), 493-507. https://doi.org/10.23857/dc.v7i3.1946

Morais Mulaza, M., Traba Ravelo, Y., & del Pozo Álvarez, P. L. (2019). Esquema lógico para la gestión financiera del desarrollo social municipal de Angola. Observatorio de La Economía Latinoamericana, mayo. https://www.eumed.net/rev/oel/2019/05/gestion-financiera-desarrollo.html

PCC. (2017). Lineamientos de la Política Económica y Social del Partido y la Revolución para el período 2016-2021. UEB Gráfica. Empresa de periódicos. http://www.granma.cu/file/pdf/gaceta/%C3%BAltimo%20PDF%2032.pdf

Pineda Nebot, C., Abellán López, M. Á., & Gonzalo Pardo Beneyto. (2021). Los presupuestos participativos infantiles como metodología de aprendizaje cívico. Un estudio exploratorio sobre la experiencia española. Sociedad e Infancias, 5(Especial), 159-170. https://doi.org/10.5209/soci.71325

Rivera García, A., & del Pozo Álvarez, P. L. (2016). La gestión del financiamiento para el desarrollo local. Revista Caribeña de Ciencias Sociales, junio. https://www.eumed.net/rev/caribe/2016/06/financiamiento.html

Traba Ravelo, Y. (2014). Procedimiento de planificación financiera para los requerimientos de la estrategia de desarrollo municipal [Doctorado en Ciencias Económicas]. Universidad de Camagüey «Ignacio Agramonte Loynaz».

Vega Campos, M. Á., Valentín Mballa, L., & Ibarra Cortés, M. E. (2019). Los avatares del financiamiento para el desarrollo local en México: Perspectivas decisionales de instituciones bancarias. TERRA: Revista de Desarrollo Local, (5), 148-173. https://doi.org/10.7203/terra.5.14088

Conflict of interest:

Authors declare not to have any conflict of interest.

Authors' contribution:

Raysa Capote Pérez and Carlos Cesar Torres Paez participated in the conception and design of the study, were involved in the collection and analysis of the data, and prepared the draft.

Raysa Capote Pérez was involved in data collection, analysis and interpretation.

Carlos Cesar Torres Paez and Luis del Castillo Sánchez made a critical revision of the article with important contributions to its intellectual content.

All the authors reviewed the writing of the manuscript and approve the version finally submitted.