Cooperativismo y Desarrollo, January-April 2019; 7(1): 74-96

Translated from the original in Spanish

Methodology for the integral management of risks and insurance with a cooperative social management approach

Metodología para la gestión integral de riesgos y seguros con enfoque de gestión social cooperativa

Martha María Cruz Bravo1, Michel Alfonso Morejón2

1Centro Universitario Municipal de

Consolación del Sur. Universidad de Pinar del Río "Hermanos Saíz Montes de Oca". Cuba. Email: mcruz@upr.edu.cu

2Cooperativa de Créditos y Servicios

"José Hernández León", Consolación del Sur, Pinar del Río.

Cuba.

Received: January 29th, 2019.

Accepted: February 4th, 2019.

ABSTRACT

The agricultural sector in Cuba constitutes a key sector in the objectives of sustainable development; with a high degree of vulnerability in a scenario plagued by threats and risks of various types. In this context, there are still serious difficulties in agricultural organizations to implement policies to manage the risks to which they are exposed. In the basic productive organizations, as in the case of the Credit and Services Cooperatives of Consolación del Sur municipality, the risks are not managed with an integral approach. The objective of this work was to design a methodology that allows to manage all the risks that these organizations face in an integral way; core aspect within cooperative social management. During the research, it was possible to contrast the results obtained from the study of different methodologies, adjusting and validating it for the integral management of risks in the Credit and Services Cooperatives, object of study, which was based on the guidelines of the ISO 31000/2018 standard on risk management and ISO 26000 on Corporate Social Responsibility, which have in common the focus of interest group, which is expressed in the efficient and effective fulfillment of the commitment of these organizations with the whole society. The main results consisted on the design and partial validation of the methodology in the Credit and Services Cooperatives "José Hernández León" of Consolación del Sur municipality, concluding that it is flexible and has the possibility to be applied to different companies in this sector.

Keywords: integral management; methodology; risks; social responsibility.

RESUMEN

El sector agropecuario en Cuba es considerado clave en los objetivos del desarrollo sostenible, con alto grado de vulnerabilidad en un escenario plagado de amenazas y riesgos de diversos tipos. En este contexto, aún existen serias dificultades en las organizaciones agropecuarias para implementar políticas para la gestión de los riesgos a los que se exponen. En las organizaciones productivas de base, como es el caso de las Cooperativas de Créditos y Servicios del municipio de Consolación del Sur, no se gestionan los riesgos con un enfoque integral. El objetivo de este trabajo fue diseñar una metodología que permitiera gestionar, de manera integral, todos los riesgos a los que se enfrentan dichas organizaciones; aspecto medular dentro de la gestión social cooperativa. Durante la investigación, se lograron contrastar los resultados que se obtuvieron a partir del estudio de diferentes metodologías, ajustando y validando la misma para la gestión integral de riesgos en la Cooperativa de Créditos y Servicios objeto de estudio, que tuvo como base las directrices de la norma ISO 31000/2018 sobre la gestión de riesgos y la ISO 26000 sobre la Responsabilidad Social Empresarial, las cuales tienen en común el enfoque de grupo de interés, que se expresa en el cumplimiento eficiente y eficaz del compromiso de estas organizaciones con toda la sociedad. Los resultados principales consistieron en el diseño y validación parcial de la metodología en la Cooperativa de Créditos y Servicios "José Hernández León" del municipio de Consolación del Sur, concluyendo que la misma es flexible y tiene posibilidad de aplicarse a diferentes empresas de este sector.

Palabras clave: gestión integral; metodología; riesgos; responsabilidad social.

INTRODUCTION

The agricultural sector in Cuba must become one of the key sectors of the Cuban economy, due to the levels of production it must contribute to industry, tourism and the important responsibility of producing basic foodstuffs for the food security of Cuban society. On the other hand, this sector employs a considerable percentage of the economically active population in our country and constitutes an important source of income for workers and for local development in the territories; it is also highly heterogeneous socioeconomic and cultural and directly impacts on phenomena such as deforestation, water consumption, soil degradation and pollution, which represent negative impacts on the environment.

Climate is a determinant for agricultural production and Cuba has historically been very exposed to climate variations, particularly to events such as hurricanes, floods and droughts that have caused great losses. In addition to climatic threats, agricultural producers are exposed to others of diverse nature, such as those of anthropogenic origin (fires, pollution and floods caused by human beings, occupational accidents, among others), economic (volatility and variability of prices) and financial (fluctuations in exchange rates and interest rates, fluctuations in national and international prices of inputs, raw materials and agricultural products themselves, etc.).

If sustainable development objectives are to be achieved, especially at the local level, it is important to strengthen the tools to manage the risks and threats faced by the agricultural sector, from a comprehensive approach and an optimal cost-benefit combination, based on the management of vulnerabilities and the effective use of insurance, as a fundamental part of the response to share and reduce the level of total risk, in all state-owned business organizations, cooperatives of various types and private enterprises.

Von Hess and de la Torre (2009) define integrated risk management as "a social process whose ultimate goal is the reduction and attention, or the permanent prediction and control of disaster risk in society, in line with and integrated with the achievement of sustainable human, economic, environmental and territorial development guidelines".

Integrated risk management can be prospective and corrective. According to Kámiche (2007), prospective management is the process oriented to the implementation of measures that prevent the formation of conditions of vulnerability or that propitiate situations of danger. Corrective management is the process by which measures are taken to reduce existing vulnerability.

In this sense, it is necessary to design policies, procedures, measures and practices adopted for the treatment of risks, that is, to establish the context, identify, analyze, estimate, evaluate, control, monitor and communicate risks.

According to SICA (Consejo Agropecuario Centroamericano. NU. CEPAL, 2013), tools, procedures and methodologies for integrated risk management in the agricultural sector must take into account some essential variables, such as hazards in their various forms: natural, socio-natural and anthropogenic, and the inability of these organizations to deal with hazards based on physical, environmental, economic, social, political, educational, ideological and cultural, institutional and organizational conditions. In other words, the level of vulnerability, as well as the capacity to face a threat or resist its impact and, of course, the risk and its materialization in a disaster.

Risk management in the agricultural sector is conceived as a decision-making process whose final objective is, in the first place, to eliminate those risk factors that can be discarded, reduce vulnerability and increase the capacity to decide and plan activities for prevention, mitigation and management of risks and threats (Cruz Bravo, 2005).

Comprehensive risk management is based on an understanding of the threats and vulnerabilities of this vital sector; the threats are associated with exogenous factors that endanger the stability and functionality of productive base companies and organizations, among which are the most important natural and climatological ones. Vulnerability is related to the capacity of a company or community to face threats and risks and is expressed in terms of physical, environmental, economic, social, political, educational, ideological and cultural, institutional, organizational conditions, among others. This capacity will be greater or lesser to the extent that these risks and threats are managed in an integrated manner, including the participation of insurance companies, as one of the most important ways to share and transfer risks.

In recent years, several methodologies have been designed to manage risks in a comprehensive manner; almost all have been based on the Australian/New Zealand AS/NZS 4360: 1995 risk management standards and the Canadian CAN/CSA-Q850-97: 1997 methodology, which provide, in general, a logical sequence of steps for any organization to adequately manage risks. These range from the establishment of the context (internal and external), identification, evaluation and treatment of risks, to the stage of supervision, monitoring and communication of risks. Subsequently, the ISO 31000/2009 Standard emerged, which became a standard that provided the tools to apply an adequate, efficient and effective risk management structure. This standard has been replaced by the new version of ISO 31000/2018, which is an opportunity for organizations to reassess their current risk management methodologies and build an integrated management system at all levels of the organization.

After an analysis of these methodologies, it can be concluded that they all have points in common such as: they conceive risk management as a process constituted by stages and closely linked to the planning for the achievement of the strategic objectives of an organization, especially in a sector as vulnerable as agriculture; in addition, for most authors, risk management is a tool for management, in order to reduce and avoid exposures to losses and achieve greater comprehensive security to entities. Among the non-common points are the number of stages or phases of this process. For some, the risk management process should contain three stages, others five stages and others up to ten stages; however, in general the content of the same in its essence does not change, there are also discrepancies in how to deal with the process of treatment of risks, control techniques, risk reduction and financing.

What is of general consensus is the importance of risk management in the integrated management of agricultural organizations, especially cooperatives; however, the methodologies studied lack process and stakeholder approaches. The latter is one of the principles underpinning the cooperative integrated management approach: Corporate Social Responsibility (CSR). On the other hand, it does not focus on the supervision, monitoring and communication stage, as a transversal axis of the whole process of integral risk management.

As part of the review of academic research carried out in Cuba on integral risk management in agricultural cooperatives, only the stages dictated by resolution 60/2011 issued by the Comptroller General of the Republic (2011) are reflected in its second section: Risk management and prevention, which stipulates three fundamental norms:

a) Identification of risks and detection of change

b) Determination of control objectives

c) Risk prevention

This resolution, although it establishes that the processes of identification, evaluation and quantification of risks are carried out by processes, activities and operations, does not provide a methodological guide to guide organizations in how to carry out an integral risk management process; a process that is vital, especially for a sector as vulnerable as the agricultural sector, integrated by cooperative organizations, which in the case of Cuba, constitute a model prioritized by the state for agricultural development in the current Cuban context, in terms of food security and sovereignty, on the basis of the much needed sustainable development.

For this reason, it is necessary to design a methodology that allows the management, in an integral manner, with a focus on processes and interest groups, of the wide range of risks to which agricultural cooperatives of any type are exposed in our country. Continuous improvement must be present throughout the entire process of integral risk management, designing indicators at each proposed stage so that the integral risk management process can identify points for improvement in each measurement.

In the specific case of Consolación del Sur, one of the most important municipalities in the country, the agricultural sector is predominant, so it urgently needs integrated risk management of the basic production units of agriculture and the National Association of Small Farmers (ANAP). Among these, the Credit and Service Cooperatives (CCS) have a great weight.

Integral risk management should constitute the transversal axis of cooperative integral management in Cuba for sustainable development and the improvement of the management of these forms of production, which is of importance in the updating of the Cuban economic model, aspects that are included in several of the guidelines of the economic and social policy of the country. Achieving an efficient and effective integral risk management process requires the participation of all members of the collective, following the basic principles of participatory democracy and shared Cooperative Social Responsibility (CSR), which implies a high commitment to improving the quality of life of members, their families, the community, local development and society in general.

The creation of Credit and Service Cooperatives, Agricultural Production Cooperatives and Basic Cooperative Production Units constitutes an important expression of the country's agricultural policy, which recognizes the cooperative movement as the fundamental base on which the agricultural business economic system is built (Nova, 2004).

The development of the cooperative process in our country has gone through three fundamental stages and they respond to the emergence of non-state forms of organization of agricultural production that exist today: the Cooperatives of Credits and Services (CCS), created in 1961; the Cooperatives of Agricultural Production, created in 1975 and the Basic Units of Cooperative Production, constituted in 1993. These cooperative forms have been defined in the Law No. 95 of Cooperatives of Agricultural Production and of Credits and Services and in the General Regulation of the Basic Units of Cooperative Production (Mirabal, 2014).

The cooperatives in our country own more than 70% of the cultivated land and guarantee more than 80% of the national agricultural production; hence the important role they play in food production and in achieving the much-needed food security and sovereignty.

The CCS were the first cooperative forms that were created in Cuba, made up of private peasants, associated to strengthen their capacities to manage and contract credits, resources and services with state and non-state entities; since their creation until now, these have shown high levels of efficiency and productivity, which have been decisive in critical moments that the country has lived, in these years of revolution.

This research was carried out in a Credit and Services Cooperative of the municipality of Consolación del Sur, for its important contribution to local community development. The CCS "José Hernández León" is located within the four cooperatives of the province inserted in the movement of the 100 thousand quintals and one of the productive entities of base that conform the productive pole of the municipality of Consolación del Sur. In recent years, this entity has suffered significant losses due to the occurrence of different types of events, especially natural ones, valued at approximately 402,115.00 pesos, which is why the board of directors of this entity requested the design of an instrument that would allow the integral management of the risks of losses, also known as pure risks.

MATERIALS AND METHODS

As in any scientific research, it was considered pertinent to carry out an analysis of the integral risk management process in the current Cuban context, especially in cooperative entities, which reflected the state of practice in this subject, which made it possible to later sustain the key stages of the proposed methodology and the preliminary results of its validation in the CCS "José Hernández León", which constitutes the fundamental objective of the present work.

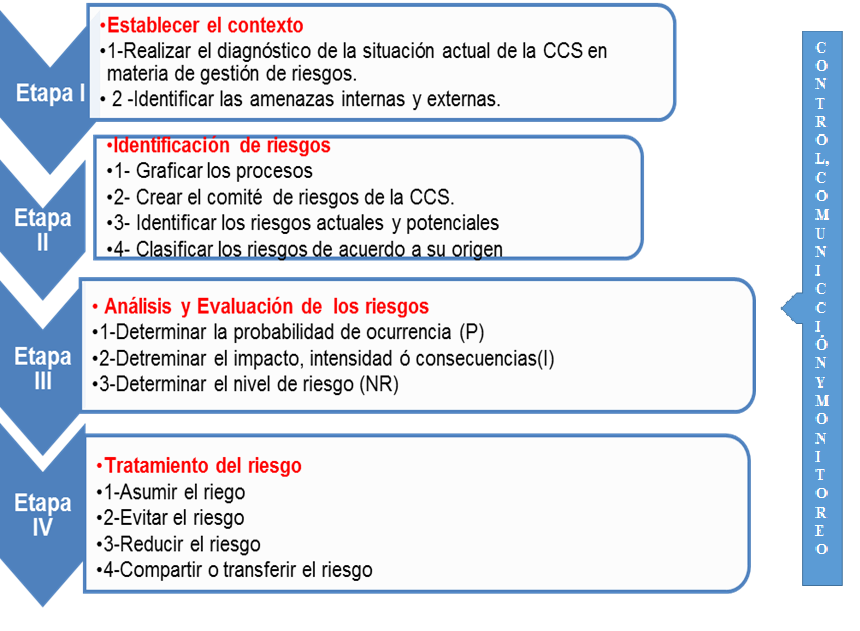

The diagnosis of this research was made based on the methodology adopted by De la Nuez (2005). This methodology proposes several outstanding stages that were later developed (see figure 1).

Fig. 1. - Methodology for the diagnosis of the current situation of integral risk management in the CCS "José Hernández León"

Based on the characteristics of integral risk management and its component elements and taking into account the object of study, a list was drawn up of the information required to carry out the research, including the following: The following documents, among others, made it possible to establish, first, the current state of comprehensive risk management in Cuba and especially in basic agricultural cooperative entities; as well as the existing gaps, from the legal and procedural point of view, in terms of risk management, on the basis of the social responsibility that should characterize these organizations.

Subsequently, the sources of information used were identified and defined in accordance with the required information needs. In this study, secondary sources will be used in the first instance: documentary analysis, to pinpoint information needs and primary sources of information: structured individual interviews with key actors and semi-structured dialogues with the different interest groups, to identify the need for information and the most important sources for providing it.

For the compilation of the information, the necessary documents provided by the CCS "José Hernández León" were reviewed. A guide was then made for structured interviews and surveys of key actors: president of the CCS, plant health technician, insurance agent, specialist in human resources and cooperative members, with the intention of determining the level of integration and the regularities of the diagnosis and to better focus the algorithm of work during the research process.

In order to identify the risks of losses in the cooperative, interviews and consultations were carried out with experts in each area of the entity and surveys were carried out among cooperative members.

The main objective of these tools was to understand the causes of the risk and its consequences, whether internal or external. This activity was carried out without taking into account the risk schemes identified in previous studies for the achievement of the proposed objective, that is, starting from zero, taking as a reference the existing diagnosis in the entity, where the possible relevant risks were identified, broken down by subsystems.

For the application of these surveys and in order to make an adequate selection of the sample, a statistical technique was applied: Simple Random Sampling (MAS), which made it possible to determine the size of the sample. They were applied to a known population size of (N) of 297 co-operators, being the maximum sample size of 0.5, with a reliability level, (1-a) of 90% and an absolute error (d) of 0.05, resulting in a sample to be surveyed of 142 co-operators, representing 48% of the total.

The diagnosis was satisfactory, as it allowed a detailed analysis of the existing problems in the CCS. The responses to the inquiry indicate that there is general knowledge on the subject of risk management, especially associated with the development of the risk prevention plan and resolution 60/2011 of the Comptroller General of the Republic (2011). However, there is no comprehensive methodology to manage the risks faced by the CCS. The lack of knowledge about the existence of risk assessment methods that could prevent or minimize, for example, labor risks and others such as environmental or technological risks that also regularly affect the entity is highlighted.

It was corroborated that the cooperative under analysis does not have a multidisciplinary team of experts; this function is currently carried out by a group of workers who are not suitable to form part of this team, since they do not have sufficient level of expertise or knowledge on integral risk management, which diminishes the possibility of adequately valuing and, with specialized criteria, the risks identified in each of the processes analyzed, preventing accurate decisions on the final treatment of the risks.

After an exhaustive analysis of the previous work, the documentation collected and the interviews conducted lead to the following conclusions:

a) There is little information and a great lack of knowledge of risk management techniques.

b) There is a lack of updating of the risk prevention plans and the safety and protection programmes drawn up by the entity.

c) There is a lack of knowledge on the part of senior and middle managers and workers of their responsibilities and functions within integral risk management; this is not conceived as a transversal axis of the cooperative management process.

d) Risks are not managed from an integral approach, nor from a socially responsible perspective; only some isolated elements of protection and hygiene at work and resolution No. 60 of 2011 of the Comptroller General of the Republic are regulated.

e) There is a great variety of risks in the "José Hernández León" CCS, mainly in the activities of various crops, sale of milk and meat; in it there are current and potential risks that were identified and analyzed using various techniques including: interviews and surveys, detecting, in a preliminary manner, a total of 29 risks in the processes under study.

f) Of the risks identified, those that occur most frequently are those of natural and anthropogenic origin, within the own cooperative.

RESULTS AND DISCUSSION

The proposed methodology for integrated risk management in agricultural cooperatives took into account, in addition to the results of the diagnosis of the organization's current situation with regard to integrated risk management, the changes of all kinds (legal, environmental, economic, social and political) in the environment in which CCS and other cooperative organizations operate, which demonstrate the need to apply a methodology for integrated risk management, based on the principle of cooperative social responsibility.

To achieve an effective implementation of the proposed methodology, in this type of productive structure, it is important that the following premises are present:

The proposed methodology has the following steps, which are shown in figure 2.

Fig. 2. - Methodology for risks integrated management selected and adjusted from ISO 31000-2018

Below, there are the essential aspects to be taken into account for the development and implementation of each of the proposed stages:

First stage: setting the context

Objective: to determine the internal or external factors that may generate risks that affect the fulfilment of the entity's strategic objectives.

External factors: socio-political changes in the environment, the country's economic-financial situation, climatic phenomena, environmental changes, the introduction of new technologies, legislative changes (pricing policies, tax law, among others), variation in product demand, etc. From the point of view of social responsibility with local development, it is important to take into account the Municipal Development Strategy and the Integral Development Plan, which determine the social, economic and political commitments with local development, with a focus on interest groups.

Internal factors: in this aspect it is necessary to take into account the quality and characteristics of the members of the CCS, information failures, changes in administration, structure and infrastructure of the cooperative, operational failures in the activities of contracting, production and marketing, economic, services, organic functioning, security and protection and finally in the insurance activity.

This stage allows us to have a systemic vision of integral management, in order to formulate and operationalize risk management policy, taking into account such key aspects as changes in consumer habits, technological changes (technological innovation), regulatory changes, changes in legality, as well as environmental and demographic factors, among others.

Second stage: identification of risks by processes and their classification

This component has three objectives:

1. Identify and graph the main, management and support processes that exist in the co-operative.

2. Identify current and potential risks to which the main CCS processes are exposed.

3. Classify risks according to their origin.

To achieve the first objective, it is important to have the general map or macroprocess of the CCS or flowchart at hand. Subsequently, the process cards of each one of these are made with their respective maps, indicating those responsible for each one. This can be summarized in the following actions:

1. Develop the map of processes, which includes:

a) Strategic processes: processes that guide and direct key and supporting processes (board of directors, economy and human resources).

b) Key processes: the raison d'être of the cooperative, the main objective of the agricultural activity (agriculture, meat and milk production and distribution).

c) Support processes: those that support one or more of our key processes (construction and turning services, input storage, security and protection).

2. Describe the processes (describe how each process is developed: responsible, customers, etc.).

3. Graphical representation of the processes.

To achieve the previous tasks it is important that the risk management committee identifies the present and potential risks that might affect the fulfilment of the strategic objectives stated by the cooperative, starting from the definition of the identification bases, as well as taking into account the impact character, if they are avoidable or not and their nature. It is convenient that the CCS applies a unique method for the analysis of each type of risk. In this way, the possibility to contrast the data through the time is guaranteed, giving the management the possibility to analyze the risks easier and with more efficacious.

After identifying and listing the risks it is important to classify them, taking into account the types of risks to which each particular process is exposed and the co-operative in general. It allows homogeneity and harmony when identifying risks, since it eliminates the possibility of confusing risks with the causes that originate them and allows the possible consequences to be assessed.

Risk identification may include the following aspects:

1. Survey of all the risks that affect the fulfillment of the objectives of each particular process and of the cooperative in general.

2. To purify and integrate the risk relationship in such a way that they are not repeated and that their number is not unnecessarily excessive.

3. Determine the areas (or objectives) on which each risk impacts.

4. Separate risks by avoidable or non-avoidable.

5. Determine the initial and final impact of the risk, both within the CCS frameworks and in the community.

Several identification tools and techniques can be used to carry out the risk assessment, including: history of own and other claims, standard surveys and questionnaires, analysis of internal information (financial balances, human resources reports, occupational safety and health area).

These reports should be contrasted, having conversations with those responsible for the processes identified and described in the previous stages, together with the opinions of the members of the risk management team.

In this component it is necessary to determine the causes or risk factors, both internal and external, presenting a description of each of these and defining the possible effects.

It is important to focus on the most significant risks to the entity, related to the development of business processes and objectives. This is where the co-operative takes a proactive role, in the sense of visualizing in its strategic and missionary context the factors or events that may affect the normal course of its operations.

Subsequently, it is important to classify the risks, which makes it possible to determine the nature of the risks, as well as to have an idea of the consequences that these may cause and the actors that originate them. The risks to which a company or similar organizations are subject can be classified into two types (Sabal, 2004):

Speculative risks: those that offer the firm the possibility of winning or losing, such as the risk of investments in fixed assets, or fluctuations in interest rates.

Pure risks: those that only offer the possibility of losing, such as natural risks.

Within the groups of risks that are the object of this research are found:

I. Production risks: these are those events that affect production and are uncontrollable by man. They generally vary according to the region and correspond to natural phenomena. They can be classified as:

II. Price risks: events associated with price changes, both of inputs and of final products marketed by these productive structures.

III. Political and institutional risks: changes in policies and regulations affecting agriculture and livestock (changes in laws on the use of pesticides or pharmaceuticals and changes in regulations in countries to which they are exported).

IV. Financial risks: events related to how the business obtains and manages its resources. The most common categories are:

V. Legal risks: situations that can generate losses due to non-compliance with legal provisions and the issuance of unfavourable legal resolutions.

VI. Human and recruitment risks: events that occur to people and affect business performance (illness, injury or death). Includes losses due to the possibility of insufficient or inadequate human resources.

VII. Physical risks to assets: events in which the organization's infrastructure is affected by theft, fire, loss or abuse (equipment, buildings, raw materials, among others).

VIII. Operational risks: events that may occur during the normal course of business and that generate losses (inadequate systems, management failures, insufficient controls, fraud and human errors).

Third Stage: risk analysis and assessment (semi-qualitative assessment)

Objective: to establish the probability of occurrence of risks and the impact of their consequences, evaluating and qualifying them, in order to obtain information to establish the level of risk and the actions to be implemented.

The risk analysis will depend on the information obtained in the risk identification format and the availability of historical data and inputs from the second stage of this process.

In summary, this stage makes systematic use of available information to determine the magnitude of the consequences of events and their probabilities for establishing the level of risk. The estimated risk is compared against risk criteria given to support the decision whether to tolerate or control a risk.

At this stage it is important to carry out the following actions:

1. Determination of possible impact areas and their repercussions. It involves defining activities under analysis.

2. Assess the level of consequences of each risk within each process, taking into account the degree of impact caused by its impact on the economy, its operations, its workers, interest groups outside the CCS and the image of the organization.

3. Assess the frequency level of current risks identified and estimate the probability level of future risks.

4. Establish the relative level of risks.

5. Determination of which risks will require certain treatment and the risks that should have a level of follow-up and monitoring by the CCS.

6. Selection and prioritization of risks according to the interest of the organization.

At the risk assessment stage, an assessment and prioritization of each of the processes is carried out, based on the matrix of qualification, evaluation and responses to the risks, taking as a basis those already identified.

In order to determine the levels of intensity, consequences or magnitude of the risks and to be able to qualify them, the proposed ranges are the following:

In the chart the probability of occurrence should be assessed in a similar way to that used for the consequences:

After this assessment has been made for each of the risks identified, the level of each risk is calculated.

NR = PxI

NR: Risk level

P: Probability

I: Intensity

The level can take five significant values, which are those that appear in the risk assessment matrix explained above:

With the accomplishment of this stage, the aim is for the entity to obtain the following results:

1. Determining the likelihood of risks occurring and how this situation affects the CCS' ability to meet its objectives in the locality.

2. Calculating the impact of the consequences of risk on people, resources and coordinating the actions necessary for the CCS to achieve its sustainable development objectives, with a socially responsible approach.

3. Establishment of qualification criteria and evaluation of risks, which allow relevant decisions to be taken on their treatment.

Fourth Stage: Establish risk coverage policies

Objective: to constitute guiding criteria in decision making with respect to risk

treatment policies and their effects on the economic-financial stability of the cooperative.

The policies identify the options for dealing with and managing risks, based on risk

assessment; they allow for appropriate decisions to be taken and set risk management guidelines; in

turn, they transmit the management's position and establish the necessary action guidelines to

all CCS members and workers.

Some of the following options should be considered, which may be considered independently, interrelated or as a whole.

1. Assume a risk: this alternative is linked, above all, to the risks which, due to their characteristics, can be assumed by the entity through risk control and/or financing measures. Assuming these means avoiding them, eliminating them, reducing them and ignoring them.

2. Avoiding risk: means taking measures aimed at preventing its materialization. It is always the first alternative to consider. It is achieved when within the processes substantial changes are generated by improvement, redesign or elimination, the result of adequate controls and actions undertaken.

3. Reducing risk: implies taking measures aimed at reducing both probability (prevention measures) and impact (protection measures). Risk reduction is probably the simplest and cheapest way to overcome weaknesses before implementing more costly and difficult measures. It is achieved by optimizing procedures and implementing controls.

4. Sharing and/or transferring risk: reduces its effect through the transfer of losses to other organizations, as in the case of insurance contracts or through other means that allow a portion of the risk to be distributed with another entity, as in risk-sharing contracts.

The use of contracted insurance may be an alternative for the CCS to transfer or share the risk and safeguard the CCS's equity. Agricultural insurance is a tool that can be used to protect animals and specific crops against natural causes such as: droughts, floods, pests, strong winds, cyclones, etcetera. Encouraging the CCS management to use the different types of insurance offered by the National Insurance Company (ESEN), based on a preventive approach to integral risk management in Cuba, will reduce the weaknesses of the basic productive structures and of the ESEN in particular, and of the Cuban state in general, in achieving sustainable, sustained and socially responsible development, especially from the local perspective.

Integral risk management, preventive and proactive, require components that are present from the beginning of the process, according to ISO 31000/2018 (Spanish Association for Standardization, 2018); they are control, communication and monitoring activities.

Monitoring must be an obligatory part of the conditions for a good functioning of integral risk management in organizations of any type; the CCS are not an exception. However, in the current conditions it is necessary to design and implement a system of mechanisms for measuring and monitoring activities exposed to risks in each of the processes identified in these basic structures.

The control must be visualized and implemented with a system approach, only in this way would the systematization of the monitoring data be achieved, especially the results of the observation of the risk factors and of the risk treatment policies, in such a way that, if required, the necessary corrective measures are taken in time.

The objective of risk communication must be, within the base structure in question, to establish a system that allows those who detect risks of accidents in the work areas of each of the identified processes, to submit them in writing to the level of command that can and "must" resolve them; in this way it is essential that the risk committee of the CCS be integrated into the command line of each one of the processes, especially key and strategic.

The responsibility for communicating the risks detected and resolving them is not exclusive to the members of the risk committee, but also to the co-operators, process and area heads and the board of directors, as well as all external stakeholders with whom the CCS has a social responsibility.

The risk communication system elected by the board of directors and the risk committee of the entity should promote the following prerogatives:

Application of the methodology in the CCS "José Hernández León"

It is the first time that a methodology of this type has been applied to this CCS. Therefore, the aim is to make an approximation to the results that this tool can potentially offer, after its risk committee has been created and trained, and encouraging it to become a cross-cutting axis of the decision-making process.

Based on the results of the diagnosis and the initial study carried out by the researchers, an assembly of associates is convened by the board of directors of the CCS, in which the need to carry out a permanent and integral analysis of risks and the advantages of the same is addressed as it is incorporated as a relevant element in decision-making, based on an integral risk management process, in which the interaction between threats and vulnerabilities of the agricultural sector can be evaluated qualitatively and quantitatively in order to generate a high, medium or low risk rating in this activity.

At a second stage, the risk management and insurance group was formed and trained in the proposed methodology so that the level of exposure to current and future risks can be objectively determined, taking into account their frequency and intensity.

The risk and insurance management group was proposed and formed, made up of the following departments, specialists and workers:

1- President of the cooperative

2- Plant health technician

3- Specialist in economics, accounting and human resources

4- Veterinarian

5- Selected cooperative members

The results of the initial application of the selected methodology are shown below.

First stage: establish the context in which the CCS "José Hernández León" operates

The social, economic, environmental and legal context in which the "José Hernández León" CCS operates was preliminarily established; the regularities presented in this environment are identified, which are important conditions for an adequate integral risk management process. Among these are the following:

1. The CCS "José Hernández León", with legal domicile at kilometer 121 of the National Highway, Consolación del Sur, Pinar del Río, faces a large number of threats and risks and is very vulnerable to the occurrence of pure risks due to its social purpose (especially natural, socio-natural, technological, economic-financial and anthropogenic).

2. The CCS currently has a total of 1720.4 hectares, 297 members: 42 women and 255 men, 35 young people and 54 usufructuaries, of whom 24 are affiliated to the social security system. Its management model does not promote greater participation by rural women in the socio-economic development of the CCS and the community in general.

3. The CCS actively participates in collaborative projects of the municipality; where the most important is the collaborative project between the Junta de Andalucía of Spain and the Cuban government, which has provided a drip irrigation system and the assembly of a deep well irrigation system, as well as electrification to houses, repair of roads, construction of social facilities such as a family doctor's office, the doctor's and nurse's house, warehouse, facilities and recreation means, as well as the construction of the socioadministrative, ranchón for activities and meetings of the peasants that integrate it, among other benefits, improving the quality of life of the peasantry in that zone and the increase of the volumes of production and the incomes of the CCS.

4. The CCS is one of the four cooperatives in the province inserted in the 100,000 quintals movement and within the productive pole of the municipality of Consolación del Sur.

5. For its contributions to local development, the CCS has obtained several recognitions from the direction of the country and province, among which are: 55th Anniversary Seal of the ANAP, National Vanguard for the results achieved in the last four years in comprehensive emulation, recognition as a National Reference in Urban Agriculture.

6. In terms of risk management, the CCS has drawn up a prevention plan, but this does not cover the universe of risks and threats faced by the CCS; nor does it carry out a decision-making process that takes into account the different methods and alternatives for the treatment of risks.

7. The CCS identifies failures in the information system, changes in management, operational failures in the contracting, production and marketing activity, in the economic activity, the service activity, the organic operation activity, the safety and security activity and the insurance activity, which are sources of risk.

8. The company complies with its tax obligations and the contracts established with its customers and suppliers.

9. The CCS has an important group of suppliers and clients, both at the municipal and provincial level, which are listed below:

Main suppliers

Main clients

The tendency of these customers is to maintain and increase their demand. It is expected to acquire new customers in the coming years.

Competitors

These competitors develop and remain. No potential competitors are foreseen for the next five years.

Second stage: identification of risks by processes and their classification

In this stage, the strategic processes were identified: human resources and economy, and the management process of the board of directors. The key processes identified were agriculture, meat production and sale, milk production and sale, and distribution; the support processes identified an input warehouse, the provision of construction and turning services, and security and protection.

After identifying the key strategic and support processes, the main exposures to losses faced by the cooperative were identified, which were preliminarily identified in all the processes, as well as the causes that can cause them and their possible consequences. In this initial version 29 risks were identified, of which: natural origin, six; socio-natural origin, three; technological origin, two; economic-financial origin, five; internal anthropogenic origin, 12 and external anthropogenic origin, one.

As can be seen, the most important risks faced by the cooperative are those of natural origin and those provoked within the cooperative; that is to say, of the total risks only four of them are not caused by the inadequate action of men, so the management of the CCS and the risk management and insurance group can work more to reduce this number of risks.

Third stage: Risk analysis, evaluation and assessment

Subsequently, the identified risks are evaluated based on the estimation of the probability and severity of the possible events, which could then be categorized and/or quantified, according to the ranges proposed in the methodology.

The results of the evaluation process made it possible to determine that, of the risks

identified, nine are considered insignificant; with a lower level, nine; moderate, three; severe, seven

and catastrophic, one; always using the multiplication of the probability of occurrence by the

impact they may cause. Of the assessed risks, priority should be given to those four that

are considered serious and catastrophic, since the materialization of these risks would have

a negative impact on the achievement of the strategic objectives of the cooperative,

while paying attention to the rest, since if any change occurs they could be considered serious

or catastrophic as well. The assessment is a proposal that is made to the cooperative so that

it can subsequently apply and help control the risks, designing an action plan to determine in

what period and how often the relevant controls will be applied in each process and in the

activities they contemplate, especially the key and strategic processes.

Fourth stage: treatment of risks

Once the risks have been identified and evaluated, the decision making stage begins to determine the treatment or hedging strategies of the risks by the risk management group, together with the management of the CCS; different types of measures, operational and organizational controls are applied, as well as measures for the assumption and/or financial transfer of those risks that require it in order to reduce or eliminate their possible impacts. Based on the results obtained, a risk treatment strategy is proposed to the CCS, in which of the 29 risks, four must be transferred to the National Insurance Company (ESEN), two with financial coverage shared with the ESEN and 23 must be assumed by the CCS: five with financial coverage and 18 with technical-organizational and risk control measures, which were agreed with the risk management group and the management of the CCS, for each of the risks identified and evaluated. One of the most discussed decisions was to transfer and/or share catastrophic risks with the Empresa Nacional de Seguros (ESEN) and the funds to be created for these purposes in cooperatives and other organizations as part of insurance management.

Insurance management in comprehensive risk management

Despite the efforts of the Cuban government to promote and form an entrepreneurial culture for the use of insurance, a management approach that includes the integral management of risks and insurance in agricultural organizations has not yet been achieved in business organizations. Among these, cooperatives are no exception, despite the strong exposures to large risks to which these productive structures are exposed.

The CCS "José Hernández León" in the last five years has had considerable losses due to the materialization of different types of risks, but the ones that have had the greatest incidence have been natural risks, for example:

1. Heavy rains (losses of 1884.14 quintals of viands, grains and vegetables).

2. Drought (losses of 1119.4 quintals of viands, grains and vegetables and five heads of livestock).

3. Pests and diseases (loss of 50 heads of pigs, 325 quintals of tomato).

4. Theft of five heads of cattle.

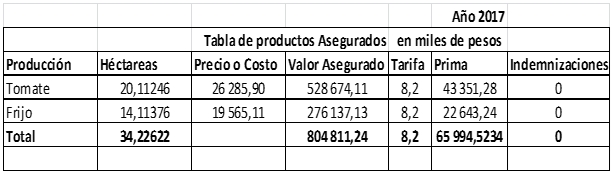

None of the lost productions were insured at the time of the incident; the losses in values are shown in table 1, starting from the prices established in resolution 908/2017 of the Ministry of Finance and Prices.

Table 1. - Estimated losses in recent years in thousands of pesos

Due to the losses caused in recent years and to the proposal made based on the results of the investigation, the management of the cooperative decided to carry out work in which they tried to promote the use of agricultural insurance in the cooperative, but very few cooperative members decided to use this tool to protect their productions; only five farmers in 2017 insured their productions, as table 2 shows. None of them received compensation, as the time when the incidents occurred was outside the dates on which these productions had been insured.

Table 2. - Products insured in 2017, in thousands of pesos

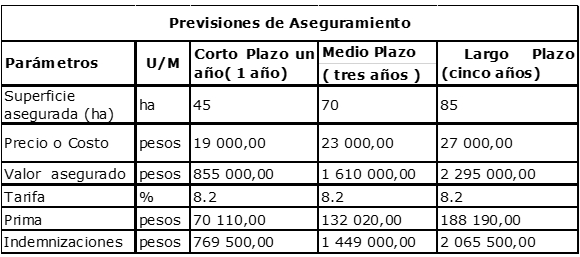

Once the mechanism and functioning of the National Insurance Company (ESEN) is known and from the experience of other cooperatives, the authors of this paper propose to the CCS "José Hernández León" a provision of insurance in a short, medium and long term period, in which if any risk of the insured materializes, the losses caused by these will be less. This forecast is shown in table 3 below:

Table 3. - Insurance forecast, in thousands of pesos

In the CCS "José Hernández León", dedicated fundamentally to the sowing of various crops, sale of milk and meat, there was no methodology for the integral management of risks and insurance, taking into account the wide range of risks to which it is exposed, both current and potential. Based on the proposed methodology, 29 risks were identified and evaluated, and a strategy was proposed for their treatment and coverage.

The CCS makes little use of agricultural insurance, especially due to the lack of knowledge of cooperative members and the lack of training in this aspect of CCS management, with its members, so a working algorithm for insurance management is proposed.

The implementation of the methodology for integrated risk management in credit and service cooperatives makes possible to manage risks in a timely and efficient manner, helping to guarantee more reliable economic-financial information for decision-making and greater stability and comprehensive security.

REFERENCES

Asociación Española de Normalización. Gestión del riesgo. Directrices, UNE-ISO 31000:2018 § (2018).

Contraloría General de la República de Cuba (2011). Resolución No. 60/2011. "Normas de Control interno". Revista de Información científica para la Dirección en Salud. INFODIR. Recuperado a partir de http://www.revinfodir.sld.cu/index.php/infodir/article/view/316

Cruz Bravo, M. M. (2005). Metodología para la Gerencia de Riesgos en la empresa azucarera "30 de noviembre" (Tesis en opción al título de Máster en Administración de empresas agropecuarias). Univesidad de Pinar "Hermanos Saíz Montes de Oca", Pinar del Río, Cuba.

De la Nuez, D. (2005). Modelo de gestión de la calidad basado en el liderazgo como valor instrumental aplicado en empresas de proyectos (Tesis de Doctorado en Ciencias Económicas). Universidad de Pinar del Río "Hermanos Saíz Montes de Oca", Pinar del Río.

Kámiche Zagarra, J. (2007). Pautas metodológicas para la incorporación del análisis del riesgo de desastres en los Proyectos de Inversión Pública. Lima, Perú: Dirección General de Programación Multianual del Sector Público. Ministerio de Economía y Finanza.

Mirabal, Y. (2014). Sistema de Contabilidad Social para las empresas cooperativas agropecuarias (Tesis en opción al grado científico de Doctor en Ciencias Contables y Financieras). Universidad de Pinar del Río "Hermanos Saíz Montes de Oca", Pinar del Río.

Nova, A. (2004). El cooperativismo, línea de desarrollo en la agricultura cubana 1993-2003. Centro de Estudios de la Economía Cubana. Universidad de La Habana.

Sabal, J. (2004). "The discount rate in emerging markets: a guide". Journal of Applied Corporate Finance, 16(2-3), 155-166.

SICA. Consejo Agropecuario Centroamericano (2013). Gestión integral de riesgos y seguros agropecuarios en Centroamérica y la República Dominicana: situación actual y líneas de acción potenciales. México: CEPAL. Recuperado a partir de https://www.cepal.org/es/publicaciones/27170-gestion-integral-riesgos-seguros-agropecuarios-centroamerica-la-republica

Von Hesse, M. & De la Torre, C. (2009). Incorporando la Gestión del Riesgo de Desastres en la Inversión Pública (Proyecto Apoyo a la Prevención de Desastres en la Comunidad Andina - PREDECAN). Perú. Recuperado a partir de http://www.comunidadandina.org/StaticFiles/Temas/AtencionPrevencionDesastres /EJET4IncorporandoGestionRiesgoDesastresInversionPublica.pdf